Prediction Markets Have Sports Pricing Problems

Posted on: January 14, 2026, 10:42h.

Last updated on: January 14, 2026, 10:51h.

- A new report suggests prediction markets aren’t offering bettors improved prospects relative to what they get at standard sportsbooks

- Bettors’ effective costs are higher on most prediction markets

- Point was widely discussed over the course of the 2025 NFL season

With sports event contracts driving massive percentages of volume for prediction markets, more attention is turning to pricing and the value proposition offered by yes/no exchanges relative to traditional sportsbooks.

A new report by sports analytics firm Bettormetrics suggests prediction market operators have a long way to go if the exchange model is going to rival standard sports betting over the long term. The research firm points out that even a prediction market with “bulletproof liquidity” doesn’t offer superior prospects to ordinary bettors relative to DraftKings or FanDuel. Fees are part of the problem.

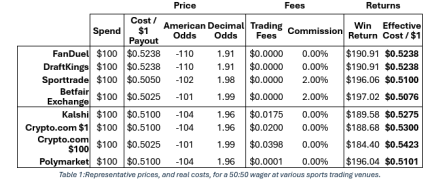

At Kalshi, the fees for any sports event contract are calculated using a particularly confusing formula equal to 7% of # of contracts x contract price x (1 – contract price),” notes Bettormetrics. “In the pick ‘em example, this equates to 0.07 x 1 x 0.51 x 0.49 = $0.017493. This must also be rounded up, so suddenly the $0.51 contract, which would ideally be $0.50, costs somewhere between $0.5275 and $0.53, depending on how many contracts are purchased. At Crypto.com, this fee is a flat $0.02, again giving a price of $0.53. At DraftKings? Well, that -110 bet is the equivalent of betting $110 to return $210. Or, $0.524 to return $1.”

As the table to the right confirms, bettors aren’t getting a superior deal on prediction markets than they would get with a standard state-regulated sportsbook.

Prediction Markets Pricing Problems Well-Known

Prediction markets’ pricing woes on sports derivatives are now widely known. Over the course of the 2025 NFL regular season, which marked the industry’s foray into sports wagering, Kalshi’s pricing was consistently worse than what was seen on DraftKings and FanDuel.

That’s likely among the primary reasons why these exchanges have siphoned just 5% of regulated sportsbook handle, throwing water on the notion that prediction markets are competitive threats to the established regulated sports wagering industry. It’s also increasingly known that retail bettors and traders are essentially chum for the sharks who are sharp bettors and market makers on prediction markets, indicating recreational punters are consistently losing cash on yes/no exchanges.

On the fee front, the still young prediction markets industry has other issues to work out, including a lack of uniformity, meaning the fee structure customers find on one exchange is assuredly different than what they see on another.

“The key takeaway here is that Crypto.com’s $0.02 fee is flat out expensive across the board and although Kalshi’s cost-based fee system reduces the additional expense at either end of the probability spectrum, the operator is still more expensive than the traditional bookmakers when an outcome is close to 50:50 (where the fair contract price is between $0.40 and $0.60),” adds Bettormetrics. “Sporttrade’s 2% commission – parallel to that we see in UK&I-facing exchanges – is far more manageable, but the 2-4% spreads are currently keeping them from being truly competitive in this measure at present.”

Polymarket May Be a Solution … Sort Of

Polymarket could be the elixir to prediction market traders’ fee concern as it’s planning fees of just $0.0001 per contract, with the only other cost to market participants being crossing of a spread. For example, a bettor may have to take on a 50-cent contract at 51 cents rather than waiting for the gap to narrow to exactly 50 cents.

But as Bettormetrics notes, there are questions around the economic viability of that model, particularly as Polymarket has investors to answer to. That group includes Intercontinental Exchange (NYSE: ICE), which invested $2 billion in the company last year. Additionally, Polymarket still isn’t live in widespread fashion in the US.

While Polymarket’s backers may be comfortable supporting this phase of growth in the short term, it remains unclear how durable such economics are over time, particularly in light of the planned 2026 launch of the ‘POLY’ token,” concludes Bettormetrics.

POLY refers to speculation indicating Polymarket could launch a native cryptocurrency at some point — a move some expect would be a boon for Polymarket adoption and prices of that digital asset.

No comments yet