Odds Favor Las Vegas Sands, MGM Resorts for Japan Casino Licenses

Posted on: October 24, 2018, 02:30h.

Last updated on: October 24, 2018, 01:29h.

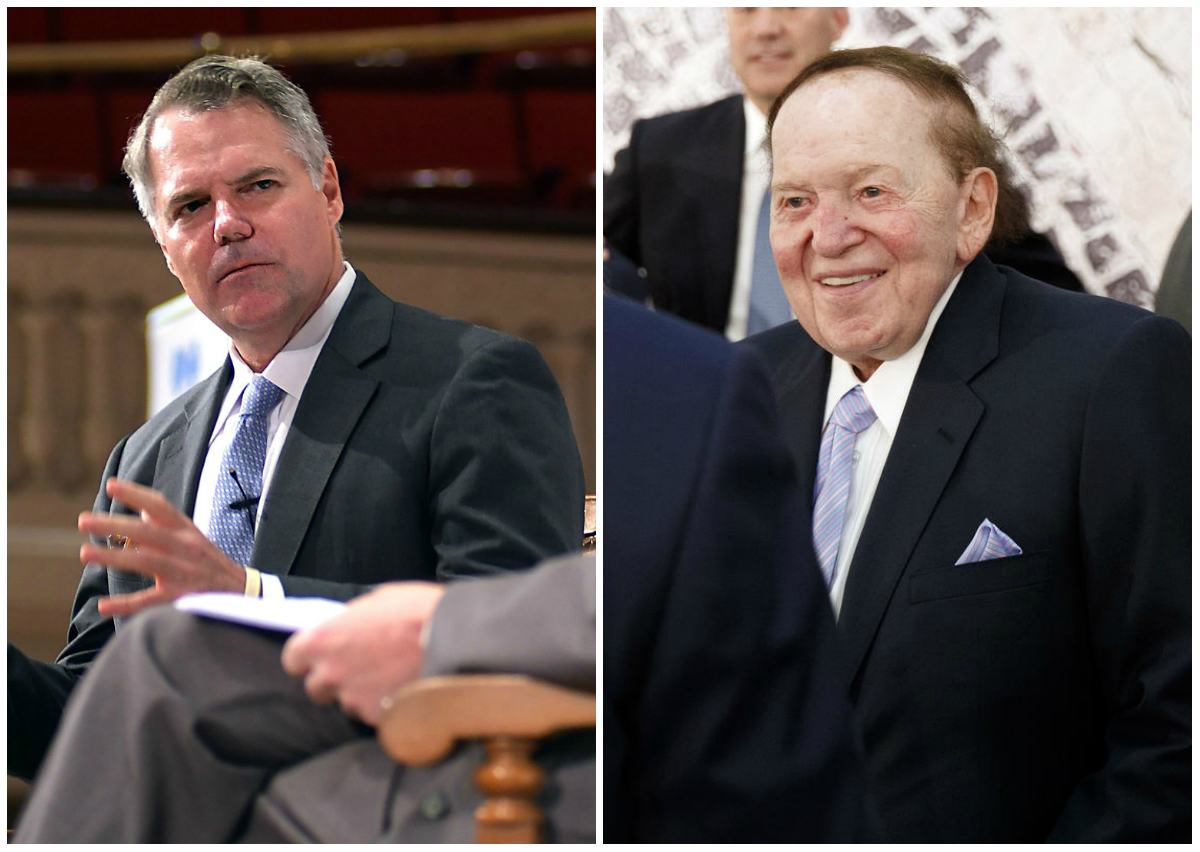

Las Vegas Sands and MGM Resorts are the odds-on favorites for integrated casino resort licensure in Japan, a leading gaming analyst said in a note issued this week.

Morningstar senior equity analyst Dan Wasiolek believes the two casino operators based in Las Vegas are best positioned to receive the blessing of Japanese lawmakers to do business in the forthcoming gaming market.

“We see Las Vegas Sands as most likely to win one of the two urban gaming licenses, due to its strong resort experience in Singapore and Las Vegas, where we believe regulation is more stringent than in Macau and the Philippines, and where problem gambling and crime issues have been controlled,” Wasiolek explained.

He added that Sands’ $13 billion in investments made in Macau since 1999 will prove to Japan that it can be a trusted long-term ally. In a statement to the Las Vegas Review-Journal, Sands spokesman Ron Reese said that while the company “happy to be recognized” in the Morningstar note, “We’ll let Japan make the ultimate determination.”

Japan Demands

Sands has long been considered a favorite for licensure, as the company operates multibillion-dollar integrated resorts (IR) in not only Las Vegas, but also Macau and Singapore. Its Marina Bay Sands has become the gold standard of IR design.

MGM Resorts also operates in Macau, the Chinese gaming enclave. Along with the opening of its $3.4 billion MGM Cotai earlier this year, the company recently invested more than $2 billion in IR properties in Massachusetts and Maryland.

Wasiolek said MGM is “well situated to receive a concession based on its leading position in Las Vegas, a market where gambling issues and crime have been well-controlled … while also displaying a strengthening balance sheet.”

Japan’s National Diet, its version of Congress, legalized commercial gambling in late 2016. In July, the legislative unit signed off on Prime Minister Shinzo Abe’s Integrated Resorts Implementation Bill that authorized three casino complexes, taxes gross gambling revenues at 30 percent, and levies a ¥6,000 (US $53) entrance fee on locals.

Aside from those conditions, much remains unknown regarding the regulatory structure of the approaching gaming industry. No matter is more critical than what specifically lawmakers will seek in determining which companies to select in awarding the coveted concessions.

Wasiolek has a few ideas. The Morningstar analyst believes a premium will be placed on operational experience in international markets, the overall fiscal health of the company, willingness and a history of partnering with local businesses, MICE (meetings, incentives, conventions, and exhibitions) expertise, and an understanding and appreciation of Japanese culture.

Candidates, Cities

The world’s biggest casino operators are all hoping to be welcomed into Japan. Along with Las Vegas Sands and MGM Resorts, Caesars Entertainment, Wynn Resorts, and Hard Rock are readying their bids.

Macau licensees Melco Resorts and Galaxy Entertainment are additionally going to present plans.

Osaka and Yokohama are likely the two designees for the casino resorts. Wasiolek predicts Sands will win Osaka, while MGM will be awarded Yokohama.

No comments yet