Wynn Stock Usually Isn’t a June Winner

Posted on: June 1, 2025, 02:00h.

Last updated on: May 31, 2025, 10:34h.

- Shares of Wynn Resorts have struggled in June over the past decade

- The stock has been one of the worst June performers over that span

Monday marks the start of the June trading month and at least well-known gaming stock faces some ominous seasonal trends.

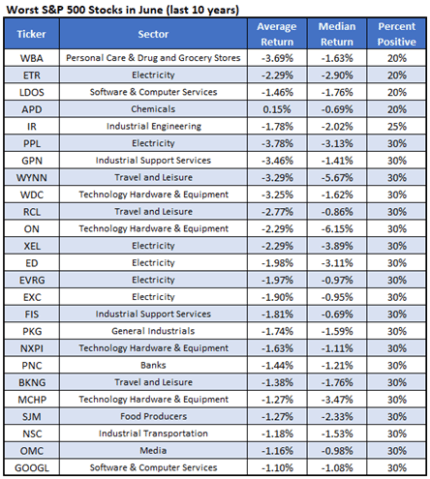

Wynn Resorts (NASDAQ: WYNN) has a tendency to sell-off in the sixth month of the year. Over the past 10 years, shares of the casino operator averaged a June decline of 3.29%, making it one of the worst-performing members of the S&P 500 during that month while notching positive showings just 30% of the time, according to Schaeffer’s Investment Research.

As noted in the chart above, Wynn’s average June loss over the past decade is the fourth-worst among S&P 500 member firms. Wynn is the only gaming equity among the 25 S&P 500 June laggards, but it is one of three travel and leisure names on that list.

Will Wynn Succumb to ‘Sell in May and Go Away?’

“Sell in May and go away” is an old investing saying referencing the fact that June marks the start of what’s typically the weaker six-month period for stocks. This year, stocks performed admirably in May and Wynn is a prime example of that trend as the stock surged 12.74% last month. On the other hand, the efficacy of selling in May and going away is often tested by the broader market’s January through April performance.

In years such as 2024, when the market was higher going into May, the seasonal impact is muted,” notes BlackRock. “However, in years when returns are negative going into May, the average return during the next five months was -1.6%, with markets higher barely 50% of the time. In other words, negative momentum exacerbates negative seasonality.”

June weakness for travel and leisure stocks, Wynn and otherwise, is arguably an indication of market efficiency and confirmation that prosaic investment theses, such as buying a stock due to elevated visitation to casinos in the summer months, aren’t always validated. In fact, those outlooks can be punished.

Seasonal trends aren’t guaranteed to repeat and in defense of Wynn, the stock is up 5.08% year-to-date. Conversely, things are lethargic in Macau — the operator’s largest market — and the Las Vegas Strip is on a three-month streak lower gross gaming revenue (GGR).

Why June Could Test Wynn Stock

This month could bring an array of tests for Wynn and other gaming equities. Escalation of US/China trade tensions would likely weigh on Macau casino stocks. Likewise, if the tariff issue rears its head again, already jittery US consumers could further scale back spending, crimping Wynn’s Boston and Las Vegas casinos in the process.

Data confirm tariffs have had an adverse effect. At the end of February, the consensus estimate for 2025 US GDP growth was 2.3%, but that forecast has since been cut to 1.3%. That could weigh on earnings growth — relevant at any point, but particularly at a time when stocks are again pricey.

“After dipping in April, the forward-looking P/E for the S&P 500 is back at historically high levels, more than 20x FY1 earnings,” adds BlackRock. “This type of premium was easier to justify last year, when growth was steady and policy uncertainty less of an issue.”

No comments yet