Sphere Stock Rallies as Analyst Sees Variety of Catalysts Driving Upside

Posted on: January 22, 2026, 11:26h.

Last updated on: January 22, 2026, 12:41h.

- Analyst lifts rating on Sphere Entertainment to “buy” from “neutral”

- Says there are multiple catalysts to contributing to bullish outlook

- Forecasts improved profitability in 2026 and 2027

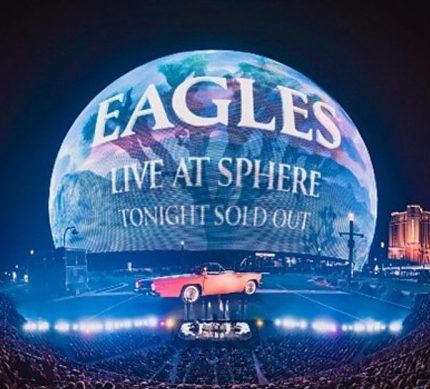

Shares of Sphere Entertainment (NYSE: SPHR) surged Thursday after a research firm upgraded the stock to “buy” from “hold.”

In a new report to clients, BTIG unveiled the upgrade and a $110 price target on Sphere stock, implying upside of 18.1% from the January 21 close. BTIG’s bullish revision to its rating on Sphere has the stock higher by nearly 6.5% in midday trading, extending a run in which the shares surged 138.7% over the past year.

“While we have always been clear on improving fundamentals, profitability, and narrative, we underappreciated execution ability under [the] backdrop of a weakening lower-end consumer (target customer really premium) and therefore rerating potential,” said BTIG in its report.

The research firm adds Sphere offers investors a “catalyst rich event path” as consumers seek more immersive live entertainment experiences.

Speaking of Catalysts for Sphere Stock…

Among the potential sparks BTIG analyst Tyler DiMatteo sees for Sphere stock is the company’s expansion plans, including the recently announced proposal to bring a “mini Sphere” to the area near MGM National Harbor in Maryland.

That venue is expected to hold 6,000 seats — far fewer than the 20K at Sphere’s flagship Las Vegas property — but DiMatteo sees the Maryland venue being a margin enhancer that adds $30 million to $50 million in annual revenue. The Maryland Sphere will be the company’s third. In 2024, it announced plans for a similar structure in Abu Dhabi.

In addition to expansion, BTIG sees Sphere stock benefiting from factors including additional sponsorship accords, more big-name concerts, and content licensing similar to what the company has with “The Wizard of Oz.” On Tuesday, the company said the “Wizard of Oz” relationship has been a boon for the Las Vegas Sphere.

“The Wizard of Oz at Sphere, the Sphere Experience that opened in Las Vegas on August 28, has sold more than 2 million tickets in total and has generated more than $260 million in ticket sales as of January 19,” according to a statement.

Increased Profitability Could Propel Sphere Stock

Over the course of Sphere’s history as a public company, there have been occasions when market observers called the stock inexpensive. It’s possible valuation gaps will narrow as the entertainment company improves profitability.

That’s exactly the scenario BTIG sees materializing as the research firm says Sphere’s profitability should improve this year and in 2027 on the back of international expansion and benefits accrued from content licensing.

Eleven sell-side analysts cover Sphere stock, with eight rating it the equivalent of “buy” or “strong buy.” The average price target on the name is $104.45.

No comments yet