Penn Says Latest Vora Presentation ‘Full of False Claims’

Posted on: May 27, 2025, 10:28h.

Last updated on: May 27, 2025, 03:04h.

- Gaming company issues addendum to fact sheet published two weeks ago

- Says Vora claims regarding executive compensation aren’t “based on the facts readily available in our public disclosure”

In the latest tit-for-tat between HG Vora and Penn Entertainment (NASDAQ: PENN), the casino operator on Tuesday issued an addendum to a fact sheet released on May 15 in which it says the hedge fund’s latest presentation mischaracterizes the gaming company’s executive compensation scheme.

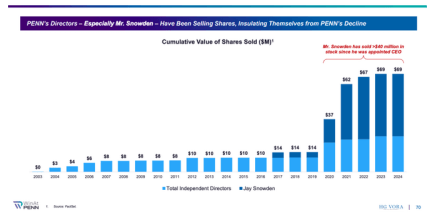

In a May 21 presentation entitled “Genuine Change Is Needed At PENN,” the activist investor chides the regional casino firm for overpaying CEO Jay Snowden, allowing him and other executives “excessive” use of private jets for personal reasons, while the stock price languished.

Executive perks like outsized private jet use signal a culture of entitlement and detachment from shareholders. At a time when the company’s interactive segment is losing money and returns are down, this behavior raises serious questions,” according to the Vora presentation.

Penn contests those claims, saying the activist investor is attempting to generate attention. Vora is attempting to procure three seats on the Penn board when the gaming company holds its annual meeting on June 17.

“We understand that claims of management enriching themselves with excessive compensation, personal use of corporate aircraft, or timely insider selling are attention-grabbing headlines; however, HG Vora’s claims are simply not based on the facts readily available in our public disclosure,” said the operator in a statement.

Penn CEO Snowden is Well-Paid

Corporate use of private jets is common in the gaming industry, though Penn isn’t the first company in the space to be wrapped for executives indulging that luxury for personal reasons. Penn owns a Bombardier Challenger 600 and a Learjet 45.

As for the claims that Snowden and other high-ranking executives are over-compensated, that may be a matter of opinion, but the gaming company has publicly disclosed that the chief executive officer would be granted up to 300K shares of restricted stock if certain share price hurdles are met.

In an April 2021 filing with the Securities and Exchange Commission (SEC), the ESPN Bet parent notes that if five price hurdles of $132, $140.94, $186.04, $245.58, and $324.16 are met by Dec. 31, 2025, Snowden would be granted 300K shares of stock.

Vora says that compensation scheme has encouraged Snowden to make aggressive, expensive wagers on online sports betting rather than focusing on Penn’s core land-based casino business.

With shares of Penn trading at $15.17 at the time of this writing, the hedge fund probably doesn’t need to worry about those equity grants, but Vora is clear about its dismay regarding the level of insider selling at Penn while the stock price has flailed.

Penn Reiterates View Vora is Running Afoul of Regulators

In a May 15 letter to shareholders, Penn accused Vora of flouting federal securities and state gaming laws. The gaming company reiterated the latter perspective on Tuesday, noting that by the hedge fund’s own admission, it has “sought to weaponize” Penn’s regulators.

HG Vora, on the other hand, has consistently disregarded the gaming regulatory regime in its pursuit to exercise control and influence over PENN without all necessary licenses,” according to the Penn addendum.

The Pennsylvania-based gaming company has approved a pair of Vora nominees — Johnny Hartnett and Carlos Ruisanchez — to the board and said it remains committed to working with all investors “to create long-term shareholder value.”

No comments yet