NorthStar Points to Product Diversification for Q3 Revenue Growth

Posted on: November 28, 2025, 11:18h.

Last updated on: February 12, 2026, 02:42h.

- Q3 revenue at $6.9 million represents 4% year-over-year increase

- Company launches new content site aimed at better targeting a wider audience with Alberta launch on the horizon

- Phase 1 of new casino lobby went live in Q3, prioritizing top performing titles

NorthStar Gaming Holdings Inc. says it’s full-on accelerating customer acquisition in Ontario going forward, in part by diversifying its content offerings, after its Q3 2025 financial results showed a 4% year-over-year increase in revenue.

The Q3 results were for the period ended Sept. 30. NorthStar owns and operates NorthStar Bets, a Toronto-based casino and sportsbook platform.

The broad strokes from the company’s financial statement: Revenue was CAD $6.9 million in Q3, a 4% increase from $6.6 million in Q3 2024. Gross margin was $2.4 million, a 14% increase from $2.1 million in Q3 2024. Profit before marketing and other expenses was $0.2 million, an improvement of $0.7 million after the company registered a loss of $0.5 million there in Q3 2024.

Accelerating Customer Acquisition

An area of efficiency that the company highlighted, like in the Q2 2025 report, was marketing spend – $2.3 million in Q3, a 21% decrease year over year, representing 31.6% of revenue compared to39.4% in Q3 2024. That continues to go down overall.

“We maintained our track record of year-over-year growth in both revenue and gross margin in the third quarter,” said Michael Moskowitz, Chair and CEO of NorthStar. “We continue to strengthen the fundamentals of the business with KPIs remaining solid and ongoing innovation helping to attract and retain customers. Our team has been implementing operational improvements that are improving the player experience while at the same time reducing operating expenses.”

Company Looks To Leverage Original Content

General and administrative exposes in Q3 2025 was $2.2 million in Q3 2025, a decrease of 16% from $2.6 million in Q3 2024. G&A expenses were 31.6% of revenues in Q3 2025, down from 39.4% in Q3 2024.

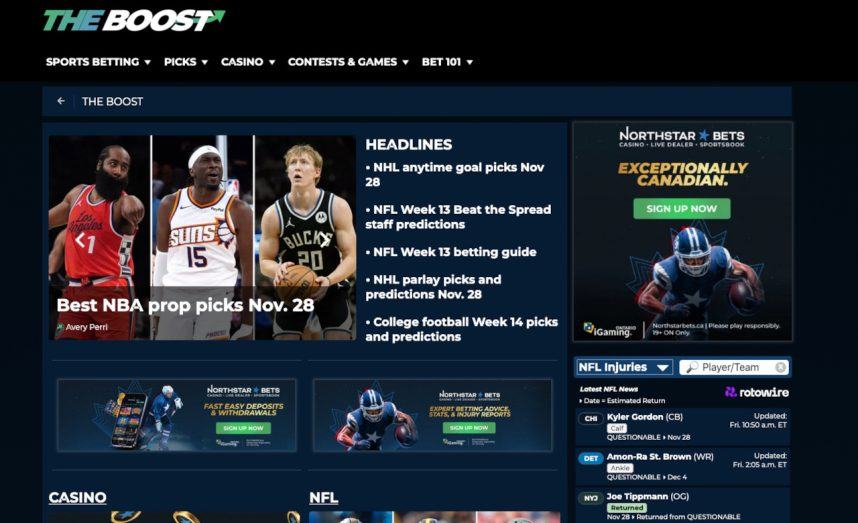

One of the highlights for the company during the quarter was the launch of The Boost, described as a platform that features original casino and sports betting content designed for Canadian gaming enthusiasts. The Boost leverages content currently produced for the company’s NorthStar Bets platform. The company expects a dedicated off-platform site like this will make its original content more widely accessible through search and social media.

“We are excited to provide more Canadians with greater access to the valuable content our team produces each day,” said Moskowitz. “From a business standpoint, the site will help us acquire new customers and build our brand awareness in Alberta as we anticipate entering a regulated market in the province sometime in 2026.”

Revenues Up 4%

Anything to give them an edge in the market. Product diversification like that will help accelerate customer acquisitions in a hyper-competitive igaming market in the province. Ontario has 48 licensed operators with 82 websites currently live. In October, according to iGaming Ontario data, the Ontario market topped CAD $9 billion in total wagers for the first time – $9.249 billion to be exact, up 8% from September. Total non-adjusted gross gaming revenue came in at CAD $367.7 million, up 12% from September, another record number for the market.

“The third quarter of 2025 represented overall growth in NorthStar’s revenue at a time where the Company’s business is maturing and the Ontario iGaming market continues to evolve,” said Mr. Moskowitz. “Looking ahead to 2026, the Company has adjusted its strategy to focus on a disciplined approach to optimize player acquisition and retention where these investments align with our financial resources and market conditions.

“As a result, management expects more moderate top-line growth driven by continued enhancements to the player experience and by prudent allocation of marketing and operating expenses.”

No comments yet