DraftKings Emerging as Live Betting Leader, Says Jefferies

Posted on: June 11, 2025, 05:41h.

Last updated on: June 11, 2025, 05:41h.

- In-game wagering increasingly popular among US bettors

- Trend could benefit DraftKings, Sportradar

- Female bettors embracing live wagers, too

In-game, or live wagering is taking off in the US and that trend has investment implications DraftKings (NASDAQ: DKNG) and Sportradar (NASDAQ: SRAD) potentially emerging as two of the main winners.

In its latest online sports betting survey, Jefferies notes in-game betting is growing, which should fuel handle upside in the industry. The research firm highlighted DraftKings and data provider Sportradar as potential beneficiaries of that scenario while acknowledging Flutter Entertainment’s (NYSE: FLUT) FanDuel possesses a deep parlay menu that could position for it in-game betting success, too.

Sportradar and rival Genius Sports (NYSE: GENI) are the leaders in providing technology to sportsbooks that’s needed to power live betting offerings. Data indicate gaming companies have to make those investments to capture the long-term growth offered by in-game betting.

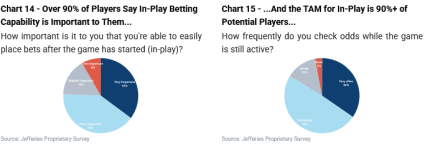

For example, while ~80% of survey respondents said that they have already placed at least one in-game bet, ~90% said that more opportunities to place bets in-game would improve their experience, ~92% said that the ability to easily place bets in-game was at least slightly important to them, and over 95% of players noted that they either checked odds in-game or considered placing a bet/taking a cash-out offer in-game,” notes Jefferies analyst David Katz.

The research firm polled 768 smartphone users in the 18-44 age range with 509 advancing to the broader survey because they indicated they’ve bet on sports at least once. As many as 40% said they’re already devoted in-game bettors and the gender gap isn’t as pronounced as some might expect with 54% of men saying they like in-game betting compared to 46% of women.

Demand Is There for In-Game, Microbetting

In what could spell good news for the longer-ranging investment thesis of the sports wagering industry, including DraftKings and Sportradar, there’s clear demand for live betting offering and that’s evolving to include microbetting.

“We looked at the most active cohort of in-play betting, microbetting (i.e., betting on the next pitch, basket, score, etc), and found that 36% of respondents had already tried microbetting, and 5% of total respondents listed it as their #1 method of betting, above pre-game bets, same-game or multi-game parlays, or even in-play bets on the outcome of the game,” adds Katz.

DraftKings has acknowledgedd importance of microbetting technology with its August 2024 acquisition of Simplebet . For DraftKings, the purchase of Simplebet could prove shrewd because microbetting is a fast-growing derivative of in-game or live betting — areas operators are pushing into in efforts to increase handle and revenue.

The Jefferies survey also found that while parlays remain the most popular wager among betters, they’re preferred method of wagering is in-game. As is expected, football and basketball remain the most popular sports among bettors with tennis surprisingly climbing the ranks.

Filter Out Noise on DraftKings Stock

Shares of DraftKings are essentially flat over the past month, arguably an accomplishment when considering Illinois raised its sports betting tax for the second time in a year — another move that targets the state’s largest operators, which are FanDuel and DraftKings.

Katz said there is noise around DraftKings stock, including the Illinois tax grab, the rise of prediction markets, and lack of new states legalizing iGaming and sports betting, but when investors get past those issues, they could realize DraftKings is one of the top ideas in the gaming, leisure, and lodging (GLL) space.

“We believe that the structural growth in the industry can’t be matched elsewhere in the GLL space, and we remain bullish,” concludes the analyst. “Additionally, we believe that 1) in-play betting could represent a new leg higher in handle, regardless of new state legalizations, and 2) DKNG is likely to be the leader in in-play due to its acquisition of SimpleBet and focus on the vertical.”

No comments yet