Bet365, Fanatics Gaining OSB Share at Expense of Two Rivals

Posted on: May 29, 2025, 07:07h.

Last updated on: May 29, 2025, 07:07h.

- Bet365, Fanatics gradually climbing US sports betting ranks

- Market share gains appear to be coming at expense of pair of older rivals

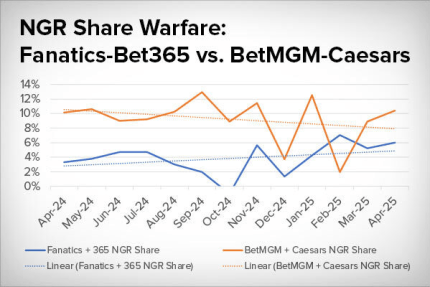

Bet365 and Fanatics are two of the younger contenders in the US online sports betting industry, but their gradually adding market share and those gains appear to be coming at the expense of older competitors BetMGM and Caesars Sportsbook.

That’s according to analysis conducted by Eilers & Krejcik Gaming (EKG), which analyzed state-level online sports wagering net gaming revenue (NGR), measuring the Bet365/Fanatics duo against BetMGM and Caesars Sportsbook. The research firm notes that last month, Bet365 and Fanatics combined for 6% NGR share — a record for the pair.

As noted in the chart above, the BetMGM/Caesars duo rebounded a bit last month, but EKG points out the two have long been ceding OSB share. Making Bet365’s strides all the more impressive is that the UK-based operator offers internet sports wagering in a list of states that’s far smaller than the overall group in which that form of betting is permitted. The company books sports bets in Arizona, Colorado, Indiana, Iowa, Kentucky, Louisiana, New Jersey, North Carolina, Ohio, Pennsylvania, and Virginia. OSB is allowed in 34 states and Washington, DC. Fanatics accepts sports wagers in 22 states and Washington, DC.

Bet365, Fanatics Could Overtake BetMGM, Caesars

The US OSB market is a duopoly controlled in stranglehold fashion by Flutter Entertainment’s FanDuel and DraftKings. Some argue that leaves smaller contenders fighting for scraps so it’s noteworthy when there are market share shifts among the bit players — something EKG sees as imminent.

The data now points to a potential Fanatics-365 overtake—an inflection that, in our view, underscores the momentum behind these ascendant challengers, and raises questions for BetMGM and Caesars about product parity and strategic identity,” according to the research firm.

Indeed, the gains notched by Bet365 and Fanatics are in part the result of those operators being liberal when it comes to marketing and promotional spending. Caesars Sportsbook and others in the industry have dialed back on those expenditures while others are keeping pace with Bet365 and Fanatics.

“Fanatics and 365 are pairing competitive product with aggressive bonusing. Caesars has eased off promo spend; BetMGM has ramped it—but with inconsistent payoff,” adds EKG.

Why Bet365 Gains Matter

Specific to Bet365’s OSB market share gains in the US, the data arrive at a crucial time because rumors abound regarding the future of that company. Recent speculation indicates the company may be engaged in talks with US investment bankers regarding a potential sale at a valuation of as much as $12 billion.

Some of the related chatter indicates Bet365 could consider a partial sale to a US private equity firm or list its shares in New York as an avenue for the Coates family to monetize its stake in the company.

Within the industry, there’s talk that if Bet365 is sold outright or a private equity firm takes on a portion of the operator, that could position it for growth in the US, indicating that its recent market share gains in this country could make the operator more appealing to prospective suitors.

No comments yet