Sports Betting Taxes Boons for State Coffers, Says Census Bureau

Posted on: December 10, 2025, 02:41h.

Last updated on: December 10, 2025, 02:41h.

- Sports betting tax revenue more than quadrupled since 2021

- It’s approaching $1 billion on a national level

- In New York, taxes on sports betting account for nearly 1% of all taxes collected

Online sports betting generates plenty of criticism, but it’s been good for boosting state tax revenue.

The US Census Bureau’s Quarterly Summary of State and Local Tax Revenue (QTAX) confirms that over the past five years, state collections of sports betting taxes surged nearly fivefold. In the third quarter of 2021, states collected $190 million in sports betting levies with that figure surging 382% to $917 million in the second quarter of 2025.

Sports betting is a growing industry, and the tax revenue it generates helps fund public schools, roads, highways, law enforcement and gambling addiction treatment,” notes the Census Bureau.

Obviously, the more states that permit sports betting, the more the aggregate tax number grows. In 2021, 30 states and Washington, DC allowed that form of wagering. With Missouri’s launch on Dec. 1, that figure has increased to 39 states.

Higher Taxes = More Revenue for States

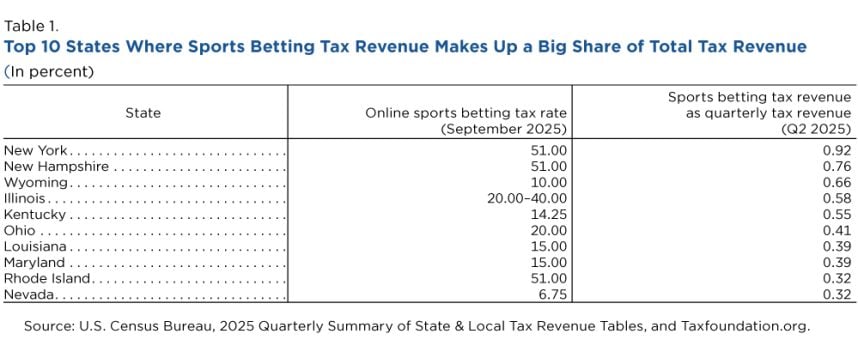

It’s not surprising that the higher a state’s sports wagering tax is, the greater percentage of overall revenue that tax accounts for. For example, New York is the largest sports wagering market in the country and it’s tied for the highest tax rate on that form of betting at 51%.

“States have varying tax rates on sportsbook revenues, ranging from 6.75% (Iowa, Nevada) to 51% (New Hampshire, New York, Rhode Island). Typically, the higher the rate, the larger the portion of a state’s total tax revenue that comes from sports betting,” according to the Census Bureau.

As noted in the chart above, the period analyzed by the Census Bureau ran through the second quarter so it’s possible the 0.58% of total tax revenue sports betting levies account for in Illinois is higher today because Gov. J.B. Pritzker (D) in July approved a policy under which the state applies a tax of 25 cents on an operator’s first 20 million booked bets and 50 cents thereafter.

Louisiana, Maryland, New Jersey, and Washington, DC joined Illinois in boosting sports betting taxes this year. Like Illinois, Maryland’s tax hike went into effect on July 1 so it’s possible the levy’s percentage of total revenue is also higher today.

Seasonal Trends Matter

As a result of the seasonality that affects sportsbook operators, state tax collections are also impacted.

“Sports betting revenue is typically higher in the winter — which includes the fourth quarter of one calendar year and the first quarter of the next — than in the summer,” observes the Census Bureau. “The first quarter of the calendar year sees the remainder of the NBA and NHL regular seasons, as well as the NFL playoffs and Super Bowl. It also includes the March Madness college basketball tournament.”

Conversely, revenue dips in the summer months when baseball is the only game in town among the four major North American sports leagues.

Last Comment ( 1 )

All the money they take in and do they ever lower taxes?