Sports Betting Doesn’t Lead to Bankruptcies, Lower Credit Scores, Says Study

Posted on: September 15, 2025, 11:05h.

Last updated on: September 15, 2025, 11:47h.

- Study runs counter to previous ones showing declining consumer credit in OSB states

- PPI says credit scores rose slightly in “early adopter” states

Regulated online sports betting (OSB) isn’t driving increased bankruptcy filings and declining credit scores in the states that permit that form of wagering.

That’s according to a new study by the Progressive Policy Institute (PPI). The organization said it found no indications of a “tidal wave” of bankruptcies and deteriorating consumer credit quality between 2019 and 2024 in states that were “early adopters” of OSB. PPI researchers defined early adopters as states that permitted internet sports wagering between 2018 and 2021, a group including New Jersey, West Virginia, Pennsylvania, Colorado, Illinois, Arizona, and Michigan, among others. The Supreme Court ruling on the Professional and Amateur Sports Protection Act (PASPA) was handed down in 2018.

Early adopter states showed a 40% decline in consumer bankruptcies between 2019 and 2024, compared to a 34% decline nationally, and a 36% decline for all states that legalized mobile sports betting,” observes PPI.

The institute also points out that during that period, average credit scores in states that were quick to approve OSB rose 1.8%, which was in line with the national average.

PPI Counters Previous Study on Sports Betting Causing Economic Strain

The PPI study runs counter to other research attempting to link OSB proliferation with expanded personal economic duress.

Last year, researchers at the University of California Los Angeles (UCLA) and the University of Southern California (USC) released a study indicating that credit scores declined slightly in OSB states and those dips were attributable to rising “bankruptcy rates, debt collections, debt consolidation loans, and auto loan delinquencies.”

The PPI acknowledges that their research and that of UCLA/USC covers periods with significant economic shocks, including the coronavirus pandemic and the 2022-23 inflation spike and subsequent surge in interest rates. The organization notes that sports betting intensity surged during the pandemic because other, in-person entertainment options were limited, but when the economy reopened, consumers reduced their exposure to sports wagering.

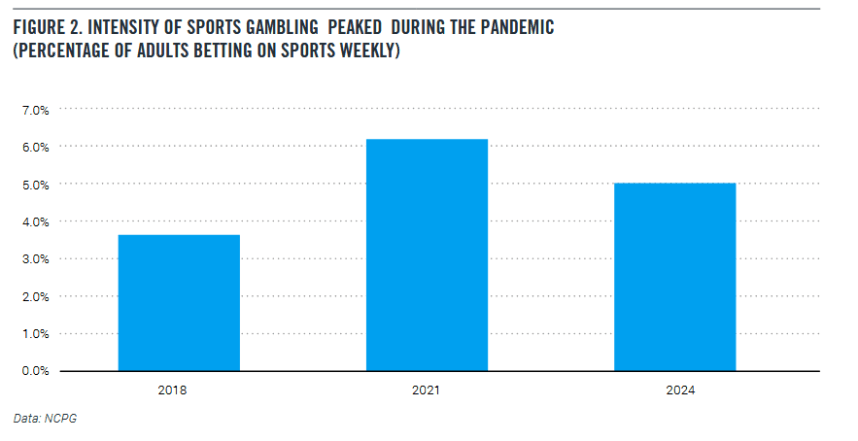

“Data from the National Council on Problem Gambling (NCPG) suggests that the intensity of sports betting rose during the pandemic and has fallen since then,” according to PPI. “For example, the percentage of adults engaged in weekly sports betting rose from 3.7% in the 2018 survey to 6.2% in the 2021 survey. The 2024 survey, however, shows a decline in weekly sports betting to 5.0% of adults. Other betting frequencies show a similar pattern.”

Sports Betting Not Contributing to More Bankruptcy, Says PPI

PPI claims OSB expansion isn’t leading to more bankruptcies. and there may be something to that assertion based on the fact that betting (in all forms) as a percentage of consumer spending has been flat in this country for the entirety of the 21st century.

“We found that the early adopter states had a consumer bankruptcy decline of 40% from 2019 to 2024, compared to the 34% national decline,” says PPI. “For example, New Jersey and West Virginia, the first two states to adopt mobile sports betting, had bankruptcy declines of 49% and 44% respectively. Meanwhile, Alabama, a state that has not adopted online sports betting as of the date of this paper, saw only a 28% decline in consumer bankruptcies from 2019 to 2024.”

Looking at credit scores, the national average increased to 715 in 2024 from 703 in 2019. Over that period, all states — not just early adopters that permitted OSB — saw consumer credit scores rise an average of 1.7%, or slightly below the national average increase of 1.8%.

While the PPI study says sports wagering isn’t causing ruin to credit scores or prompting a surge of bankruptcy filings, other research indicates some bettors are so beholden to the habit that they liquidate investment accounts to raise capital for sports betting.

Last Comment ( 1 )

The Progressive Policy Institute (PPI) is a catalyst for policy innovation and political reform. Its mission is to generate radically pragmatic ideas for governing that restore confidence in liberal democracy at home and abroad by championing the economic prospects and moral outlook of ordinary working people. That's the spirit! For extra credit, look up the definition of "radically pragmatic." Then remind sports bettors they can never bet too much on a winner!