PredictIt Lifts Limit on Political Trades in New CFTC Agreement

Posted on: July 15, 2025, 11:28h.

Last updated on: July 15, 2025, 11:49h.

- Prediction market operator boosts contract limit to $3,500

- Scraps limit on number of traders per contract

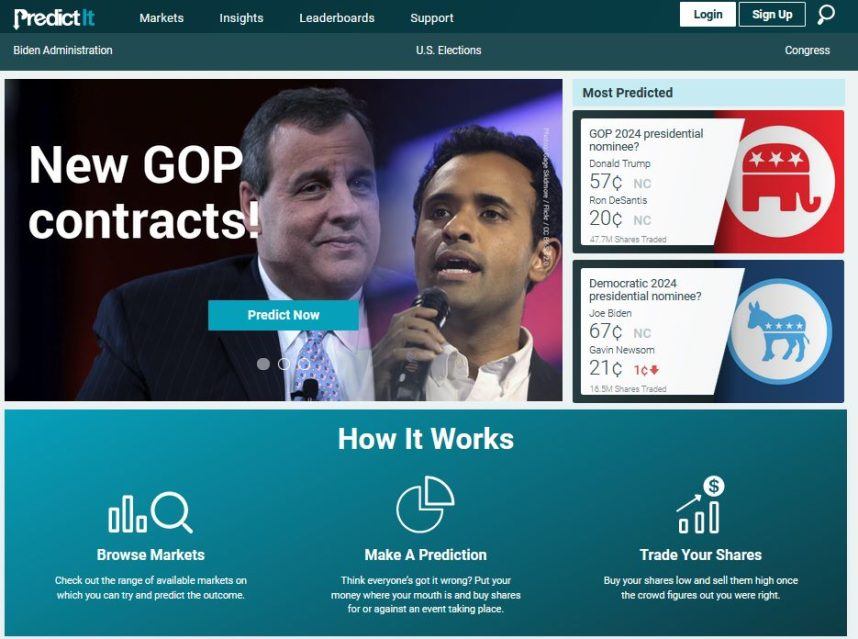

Prediction markets operator PredictIt announced Tuesday it reached a new agreement with the Commodities Futures Trading Commission (CFTC), paving the way for the company to increase liquidity and offer higher political contract limits.

PredictIt, which rose to prominence by offering derivatives on elections, said that following the new accord with the CFTC, the previous contract limit of $850 per client has been increased to $3,500 — the federal individual campaign contribution limit. The Washington, DC-based company added its previous limit of 5,000 traders per event contract has been lifted. Now, there is no cap, which could result in increased liquidity across various politically based event contracts. The news comes after PredictIt was on a regulatory hiatus.

With strengthened compliance protocols and an unwavering commitment to excellence, PredictIt returns from its regulatory pause not just as a leader — but as the benchmark for what real-money prediction markets can and should be,” according to a post on the company’s web site.

While PredictIt has encountered regulatory headwinds, it’s largely steered clear of the sports betting maelstrom surrounding rivals such as Kalshi and Polymarket. Kalshi, in particular, is in the crosshairs of multiple attorneys general because it’s offering sports event contracts while not holding state gaming licenses. The company believes it can do so because it’s federally regulated.

PredictIt, CFTC Recently Settled Litigation

News of PredictIt’s expanded limits arrives about three weeks after the company settled long-running litigation with the CFTC. In 2014, the commission granted PredictIt approval to offer political derivatives without fear of enforcement action.

Eight years later, that approval was rescinded and the CFTC gave the prediction markets operator until February 2023 to liquidate outstanding contracts. PredictIt challenged that decision in court, touching off a lengthy legal tussle.

In what could be the latest signal of a more favorable regulatory regime for prediction market firms, the CFTC/PredictIt case has been put to rest, opening the door for the aforementioned contract limit increase and, potentially, enhanced liquidity.

“The parties have reached an agreement in principle that would resolve this litigation. In the coming days, the parties will be making filings asking the Court to enter orders implementing that resolution. Until such time, the parties respectfully request that the Court continue to stay the pending motions,” according to a June filing with the US District Court for the Western District of Texas.

PredictIt Targeting More Markets

In addition to unveiling higher contract limits, PredictIt teased an expanded slate of futures contracts for traders to evaluate.

We’re dramatically expanding the number and diversity of markets available — giving traders even more ways to engage with breaking news, policy shifts, and electoral dynamics in real time,” according to the post.

That implies PredictIt has learned from Kalshi’s sports betting-related issues and will remain focused on political derivatives. Of the 25 markets currently available on PredictIt, all are related to politics, with the most heavily traded pertaining to the New York City mayoral contest.

No comments yet