Prediction Markets Aren’t Taking Share from Legal Sports Betting, Says ARK

Posted on: February 12, 2026, 10:59h.

Last updated on: February 12, 2026, 10:59h.

- Cathie Wood’s investment firm says prediction markets aren’t taking sizable share from legal sportsbooks

- Rather, “regulatory arbitrage” is at play

- DraftKings deposits outpace Kalshi in states where both are legal

Prediction markets notched massive turnover increases over the course of the 2025 NFL season, culminating in sizable volume spikes on Super Bowl Sunday, but yes/no exchanges still aren’t stealing significant market share from regulated sportsbook operators.

That’s the take of ARK Investment Management analyst Nick Grous who in a new note points out that prediction markets such as Kalshi are engaging in “regulatory arbitrage.” Translation: Those companies are capitalizing on their status as federally regulated entities to provide access to sports wagering in states where that activity isn’t legal.

Today, roughly 30 to 32 states, representing about 40% of the US population, do not have legalized online sports betting,” observes the ARK analyst. “For residents in those states, prediction markets offer something simple. Access.”

Grous adds there’s “another layer of regulatory arbitrage.” Kalshi clients must be at least 18 years old, but most states mandate sports bettors be 21 to participate in regulated markets. That three-year gap “likely explains a meaningful portion of activity in legal betting states,” says the analyst. Critics are apt to say prediction markets are exploiting a loophole, targeting a younger audience in the process.

State-Level Insight

Kalshi doesn’t shy away from the fact that it’s legal in all 50 states, frequently serving up advertisements touting the availability of sports event contracts in states such as California, Florida, Georgia, and Texas. New competing platforms from DraftKings (NASDAQ: DKNG) and FanDuel also highlight availability in those jurisdictions.

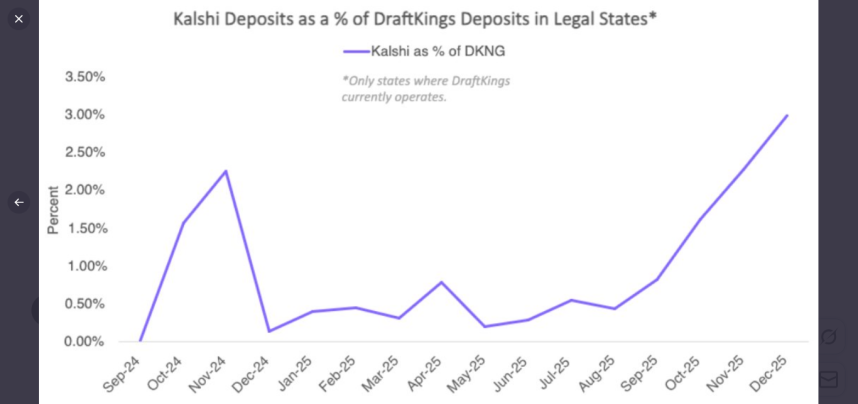

On that note, Grous points out that 60% of Kalshi’s deposits come states where online sports betting isn’t legal. In other words, the prediction market operator is meeting unmet demand for internet sports wagering in those locations. As for the states where online sports betting is legal, Kalshi’s deposit share is rising, but it’s coming of an extremely low base and is still far behind DraftKings.

“In states where both DraftKings and Kalshi operate, Kalshi’s deposits relative to DraftKings are significantly lower, representing only 3%,” notes Grous.

Prediction Markets Can Continue Growing

Although there were signs of improvement during the Super Bowl, it’s been widely documented prediction markets have inferior pricing relative to traditional sportsbook operators. However, Grous believes the industry will continue growing, helped by increased sports volume, by serving unmet demand. He also sees the event contracts industry expanding in non-sports markets.

“The real opportunity for prediction markets lies beyond sports,” he wrote. “The larger prize is in markets where the addressable opportunity is significantly greater, and competition is less direct.”

Cathie Wood’s ARK holds shares of DraftKings and Robinhood (NASDAQ: HOOD), which is one of the biggest prediction market firms, across its various exchange traded funds (ETFs) and the firm recently invested in privately held Kalshi.

No comments yet