Penn National Enthusiasm Grows on Wall Street, Analyst Raises Target to $115

Posted on: December 23, 2020, 08:12h.

Last updated on: December 23, 2020, 08:59h.

Penn National Gaming (NASDAQ:PENN) is garnering more support among sell-side observers. Rosenblatt Securities analyst Bernie McTernan is boosting his price forecast, helping the shares to modest gains in early trading.

In a note to clients today, McTernan lifts his price target on the casino operator to $115 from $90, good for the highest estimate on Wall Street. His bullish view on the stock extends a multi-month run in which Penn has become the toast of the analyst community among gaming equities. In lifting his projection on the name, the analyst cites the familiar factors of state-level proliferation of online casinos and sports betting.

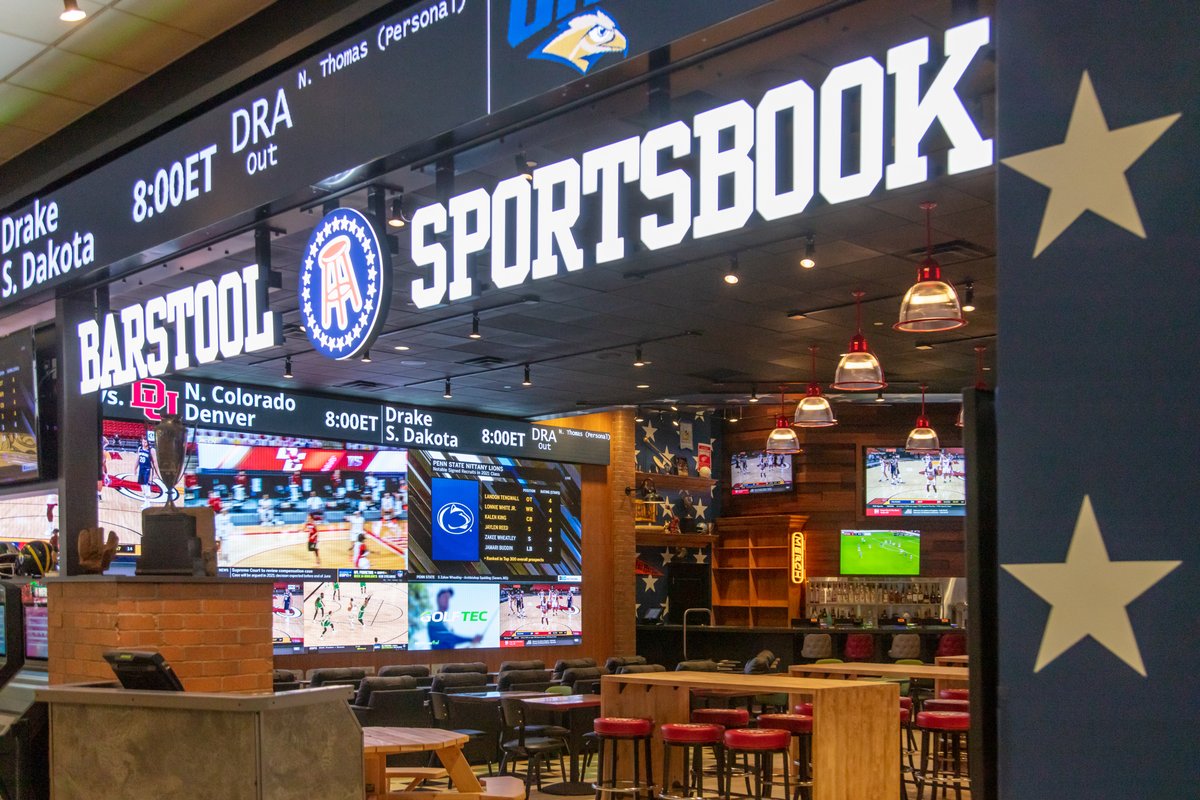

Market share in new state launches, as the Barstool sportsbook app will be at the same starting line as competitors. New state legislation for online sports betting and iGaming as state governments deal with the impact of COVID-19 on their budgets,” said McTernan.

The analyst’s affinity for Penn stock is rapidly growing. In early September, he didn’t even cover the company. On Sept. 10, he initiated coverage with a “buy” rating and an $80 estimate. By the end of that month, McTernan lifted his price target on the shares to $90.

Momentum Building for Penn Stock

The operator of casinos under the Argosy and Hollywood brands, among others, epitomizes a 2020 rags-to-riches story in the gaming space.

At the height of the coronavirus crisis, Penn stock slumped below $4, with some in the investment community pondering the company’s ability to survive. Since then, the shares are up a staggering 2,478.40 percent, as Wall Street becomes enamored by the relationship with Barstool Sports and the prospects for iGaming.

That momentum is showing essentially no signs of waning. Rather, it’s growing, as highlighted by Penn stock tacking on 15.20 percent over the past week and 37 percent over the past month.

Last week, Bank of America analyst Shaun Kelley said Penn has upside potential to $101. But that forecast may need to move higher, because the shares are flirting with $98 at this writing.

Fundamentals Backstop Bullish Thesis

Rosenblatt’s McTernan is bullish on Penn due in part to sports wagering expansion. The company is doing just that, as it’s debuting Barstool Sportsbooks today at its Greektown Casino Hotel in Detroit and at the Hollywood Casino Lawrenceburg in Indiana. Another Barstool sports betting venue will open at Ameristar East Chicago Casino & Hotel on Christmas Eve.

Additionally, the analyst sees “continued recovery at regional casinos, helped by the rollout of the vaccine, supporting Penn stock. Wall Street prefers regional operators to those with heavy Las Vegas footprints, because the former aren’t levered to business travel and convention trends on par with Sin City.

McTernan’s price estimate on Penn stock, which is the highest on Wall Street, implies upside of 20.1 percent from the Dec. 22 close. It’s also well above the consensus projection around $77, indicating some other analysts covering the name may be compelled to lift their targets.

No comments yet