Monarch Casino Inching Closer to Finding Acquisition Target, Says Analyst

Posted on: December 8, 2025, 11:48h.

Last updated on: December 8, 2025, 12:12h.

- Regional casino operator is frequently attached to M&A rumors, but hasn’t made a deal

- Company is known to be highly selective when it comes to evaluating acquisitions

- It’s unlikely to buy a casino in Nevada

Monarch Casino & Resort (NASDAQ: MCRI) is one of the gaming companies most frequently attached to industry consolidation rumors, but it hasn’t expanded its two-property portfolio.

That could be close to changing. Maybe. Following recent meetings with management of the Reno-based operator, Truist Securities analyst Barry Jonas said Monarch continues to evaluate potential acquisition opportunities.

“Management continues to evaluate the M&A landscape noting that this is ‘the most opportunistic time in the past 5 years’ for the company,” observes Jonas, who rates the stock a “buy” with a $120 price target.

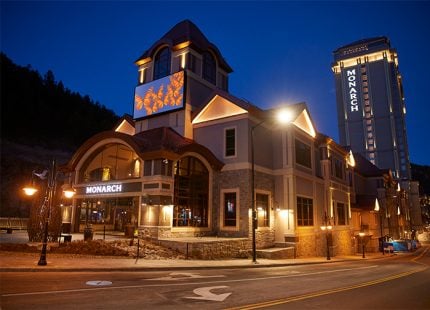

Monarch’s roster of gaming venues remains comprised of the Atlantis in Reno and its namesake property in Black Hawk, Colo. With just two venues, the company is the smallest publicly traded casino operator as measured by number of properties.

Monarch Casino Notoriously Selective Regarding Acquisitions

For as frequently as the operator is tied to industry consolidation rumors, Monarch Casino is equally, if not more so, selective when it comes to acquisitions.

That’s to say, the operator won’t do a deal simply to increase the size of its portfolio. Investors benefit from that selectivity because not all splashy gaming industry deals pay dividends for buyers and their shareholders. Some large-scale transactions can be messy and take years to benefit the buyers and their investors.

For its part, Monarch has some boxes that need to be checked before it executes a deal. As Jonas points out, the Atlantis operator would go up to 4x leverage to get a deal done, but it wants the target to have at least $150 million in annual earnings before interest, taxes, depreciation, and amortization (EBITDA) with potential to generate “high teens” return on investment.

The analyst adds that Monarch will only consider acquisitions in which real estate is included, meaning it doesn’t want to take on long-term lease obligations simply to add another casino.

Monarch Casino Has Regional Qualifications, Too

Adding to the aforementioned selectivity, Monarch has some regional qualifiers when it comes to deal-making. For example, Nevada is likely off its shopping list because it doesn’t want to threaten its Atlantis property in Reno, and it wants to avoid the intense competition in Las Vegas, according to Jonas.

Likewise, Monarch is stridently opposed to internet casinos, implying that it will probably avoid acquisitions in any of the seven states in which iGaming is permitted. Another large state with a massive casino market is also likely out of play.

“Illinois is also less desirable given the unstable regulatory environment,” concludes Jonas. “That said, management reiterated that it’s always possible to find unique opportunities even in markets with unattractive characteristics. Non-gaming hospitality venues are also on management’s radar as a potential M&A target.”

No comments yet