Las Vegas Sands Likely Frontrunner for Japanese Casino License, Investment Firm Says

Posted on: June 5, 2017, 08:58h.

Last updated on: June 5, 2017, 09:22h.

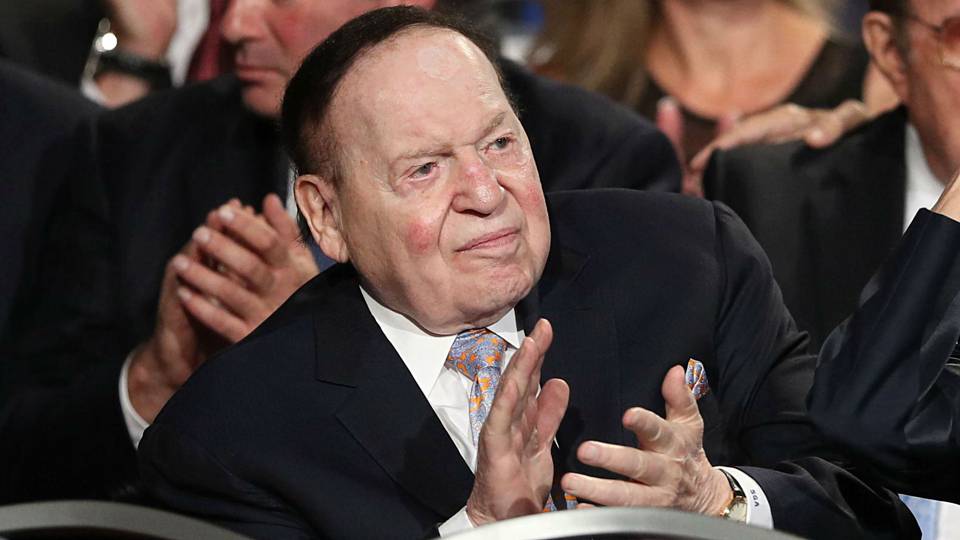

When it comes to a casino in Japan, Las Vegas Sands might have the upper hand over its rivals in bidding on one of the forthcoming casino licenses expected to be issued. That’s according to investment firm Morningstar, which believes billionaire Sheldon Adelson’s gaming conglomerate is best positioned to win a coveted permit.

In a note issued over the weekend, analyst Chelsey Tam opined, “In our view, narrow-moat Las Vegas Sands Corp is best positioned to win a gaming concession in the middle of 2019, due to its track record of managing global resorts with a strong balance sheet.”

Headquartered in Nevada, Las Vegas Sands generates more revenue than any other gaming company in the world. The resort operator reported net revenue of $11.41 billion in 2016.

In addition to its two Las Vegas properties and a resort in Bethlehem, Pennsylvania, Sands has an established presence in Asia with casinos in Macau and Singapore.

Japan Doubling Down

Morningstar’s view that Las Vegas Sands is a frontrunner for one of the casino licenses in Japan is certainly not surprising. The country’s congress is looking for well-qualified gambling operators with proven track records, as it looks to legalize its commercial casino market in the smoothest manner possible.

But Sands obtaining a license isn’t a slam dunk, either. MGM Resorts, Wynn Resorts, Genting Group, Melco Resorts, and others are hot on the trail for the most coveted Asian entry in the gaming market. The good news for all working on bids is that Japan might be issuing more licenses than previously thought. The National Diet is currently drafting a second, more comprehensive bill that will lay out the groundwork for integrated resorts (IRs).

The imminent piece of legislation will address all aspects of gambling in Japan, and that includes how many casino resorts will be allowed. While the number was expected to be two, maybe three, Morningstar believes four IRs licenses will be awarded.

The bidding period will last until 2019, when the industry analyst expects the winners to be revealed. Assuming the projects are in the $10 billion range, it will take roughly five years to construct them, meaning they won’t likely open until 2024, at the earliest.

Tax Rate Variables

Should Las Vegas Sands receive an invitation to build in Japan, Morningstar says its firm would be bullish on the publicly traded stock. That’s because it believes the Japan casinos will be able to generate $19 billion in gaming revenue, and an additional $6 billion in non-gaming income, per year.

The second gaming bill will also address tax rates for the operators, and that number will heavily influence potential investments and interest from foreign companies.

Japan’s leaders are thought to be using Singapore’s model for developing its casino industry blueprint. In the Southeast Asian country, gambling floors pay a 15 percent tax on mass market play, and five percent on VIP tables.

That’s drastically lower than in Macau, where casinos pay a 39 percent tax on gross gaming revenue. Singapore’s levy is also much lower than many states in America where gambling is permitted.

It’s yet another reason why the budding Japanese casino market is so highly sought after.

No comments yet