Las Vegas Congresswoman Susie Lee or ex-Husband Dumped Casino Stock Before Big Sell-Off

Posted on: August 27, 2025, 01:51h.

Last updated on: August 27, 2025, 02:01h.

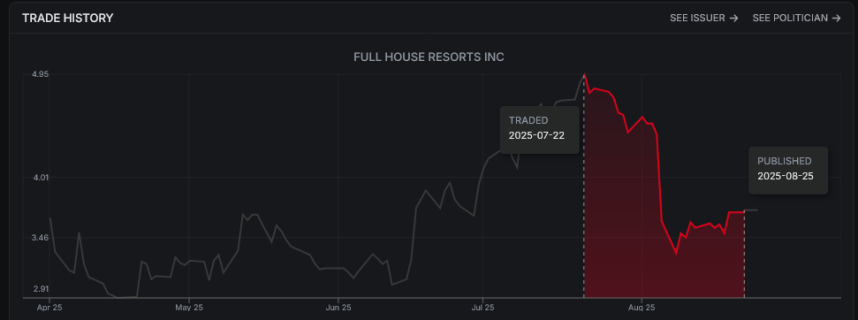

- Nevada Rep. Susie Lee sold nearly $1 million worth of Full House Resorts before the stock plunged

- By some estimates, she saved herself $300K by selling when she did

- Her ex-husband is the chief executive officer of the gaming company

There’s good timing and then there’s impeccable timing. Rep. Susie Lee’s (D-NV) recently disclosed sale of Full House Resorts (NASDAQ: FLL) stock is in the latter category.

A new congressional filing indicates Lee, who represents a portion of the casino-laden Las Vegas Valley, sold $500K to $1 million worth of Full House shares on July 22 — barely more than two weeks before the stock plunged on a downbeat second-quarter earnings report. The politician (or her ex-husband) may have saved $300K by selling on July 22 before the stock plunged 25% on August 8, according to the Stock Insider app.

By trimming exposure to the regional casino operator on July 22, Lee sold at the stock’s highest prices since late February, getting out ahead of the carnage that arrived just weeks later. Casino.org reached out to Lee’s office with a request for comment, but it wasn’t returned prior to publication of this article.

Lee’s ex-husband, Dan Lee, is the chief executive officer of Full House Resorts and it’s possible the aforementioned trade was executed on his behalf. The congresswoman has previously disclosed trades in gaming equities that were tied to her former spouse, not directly to her.

More Reasons Timing of Lee Full House Sale is Interesting

If it was Dan Lee selling the Full House shares in July, the timing of that transaction could invite as much scrutiny as if it were his ex-wife hitting the “sell” button.

Not only did the sale arrive in advance of Full House’s second-quarter earnings report, potentially signaling CEO Lee knew investors were likely to react unfavorably, it also occurred about five weeks after it was disclosed that the executive bought 276,300 shares of the gaming company’s equity. That news sparked a massive intraday rally by shares of Full House.

Including the July 22 sale, Rep. Lee’s 2025 stock trading log includes nine transactions in Full House, according to Quiver Quantitative data.

Since the start of this year, one of the Lees has engaged in transactions involving seven other consumer cyclical stocks besides Full House — a group including a quartet of gaming equities. Those names are Century Casinos (NASDAQ: CNTY), Golden Entertainment (NASDAQ: GDEN), MGM Resorts International (NYSE: MGM), and Wynn Resorts (NASDAQ: WYNN).

Some of Rep. Lee’s Trades Raised Eyebrows

While the aforementioned trades in gaming stocks may have been, or likely were, conducted on behalf of her ex-husband, Lee has raised some eyebrows with trades outside the gaming industry.

The Democrat politician drew internet scrutiny following her May 2024 buy of Rhinemetall (OTC: RNMBY), a previously obscure German industrial company that trades over-the-counter in the US. That stock has more than tripled since the politician’s purchase was disclosed.

Lee is a member of the Subcommittee on Military Construction, Veterans Affairs, and Related Agencies, stoking speculation that she knew before the general public did that Germany would commit to boosting defense expenditures. Rhinemetall isn’t a popular investment among US politicians, but Lee is joined by Rep. Gil Cisneros (D-CA) in owning the stock. He’s a member of the House Armed Services Committee.

Last Comments ( 2 )

Rediculous assertion, Alan. ANY of us could have sold at the top of the market. Given sufficient insider knowledge.....

Shocker, another CORRUPT Democrat! Lock her up!!