Kazuo Okada Fury Over Tiger Resort Takeover of Asiabest Group

Posted on: September 20, 2018, 02:00h.

Last updated on: September 20, 2018, 05:43h.

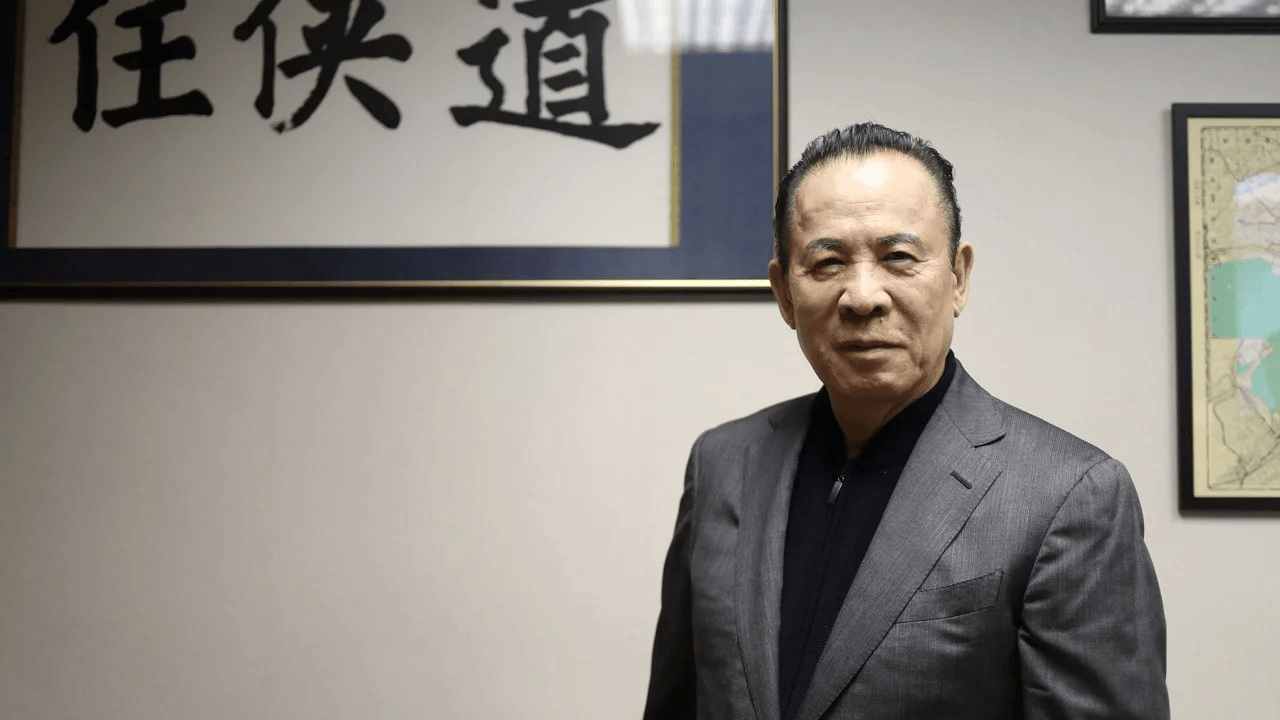

Jilted Japanese billionaire Kazuo Okada is on the warpath over the proposed acquisition of Philippine-listed investment company Asiabest Group by Tiger Resort, the operator of the Okada Manila integrated resort.

Okada has written to the Philippine Stock Exchange (PSE) to complain that he owns 34.41 percent of Tiger Resort but was not consulted about the deal.

“ABG (Asiabest Group), as a publicly listed company, should make a full disclosure of its impending sale transaction with Tiger Asia, particularly that there is a legal controversy on Tiger Asia’s authority to enter into such a transaction,” he asserts.

The Ousted Patriarch

Tiger Resorts is a subsidiary of Universal Entertainment, a company Okada founded almost 40 years ago. The pachinko and casino equipment giant had always been synonymous with Okada — until June last year when the board turned against its founder and chairman, accusing him of misappropriating $20 million of company funds through Tiger Resort.

Okada owned 69 percent of Universal through his family-owned holding company, Okada Holdings but Universal president Jun Fujimoto convinced the family to vote out the patriarch, facilitating his removal from the boards of Okada Holdings, Universal Entertainment, and Tiger Resort.

Universal pressed charges against Okada and he was detained and questioned in Hong Kong for “corruption-related offenses” last month. An investigation by Hong Kong authorities is believed to be ongoing.

“All the allegations made against me are entirely false,” Okada told This Week In Asia last month. “[Universal] is simply attempting to irreparably damage my reputation. I am confident that the investigation will prove the absurdity of these allegations and that I will be able to regain control of the companies I founded.”

Backdoor Flotation

The deal with Asiabest could ultimately lead to the backdoor flotation of Tiger — essentially the Okada Manila — on the PSE.

But Okada believes the deal should not be permitted to go through. He warned the PSE that he will file appropriate criminal, civil and administrative cases against those involved in any proposed flotation. He has already filed suit against Tiger Resort, its directors, and corporate officers on August 29, he added.

In a PSE filing on Wednesday, Asiabest Group said it had “no knowledge, or means to verify the existence, truth, and veracity of the allegations” made by Okada.

“Asiabest Group can inform [the] Philippine Stock Exchange, however, that [its] shareholders were presented with documents showing that the transaction was duly authorised by Tiger Resort Asia… and that the shareholders relied on the presumption of regularity of such documents.”

No comments yet