Kansas Sport Betting Bill Would Give All the Power to the Leagues

Posted on: February 22, 2018, 12:00h.

Last updated on: February 22, 2018, 09:35h.

A sports betting bill presented to the Kansas legislature this week would acquiesce to NBA and MLB demands for a one percent “integrity fee,” should wagering on their games become legal.

Having apparently accepted that the United States Supreme Court will shortly overturn PASPA, the federal law that prohibits state-sanctioned sports betting, the two leagues have abandoned their direct opposition to sports betting regulation, but only if it’s done on their terms.

The leagues have been aggressively lobbying in states that are considering regulation, and circulating so-called model legislation. This not only demands their one percent cut but also the power to restrict or limit betting on a particular event, at the leagues’ discretion.

The Kansas bill draws heavily from the model legislation, as do bills recently submitted in Illinois and Indiana. However, despite their best lobbying efforts, elsewhere lobbying has fallen on deaf ears. Sports betting legislation in West Virginia and Iowa have soundly rejected the leagues’ proposals.

Integrity Fee is 25 Percent Tax in Disguise

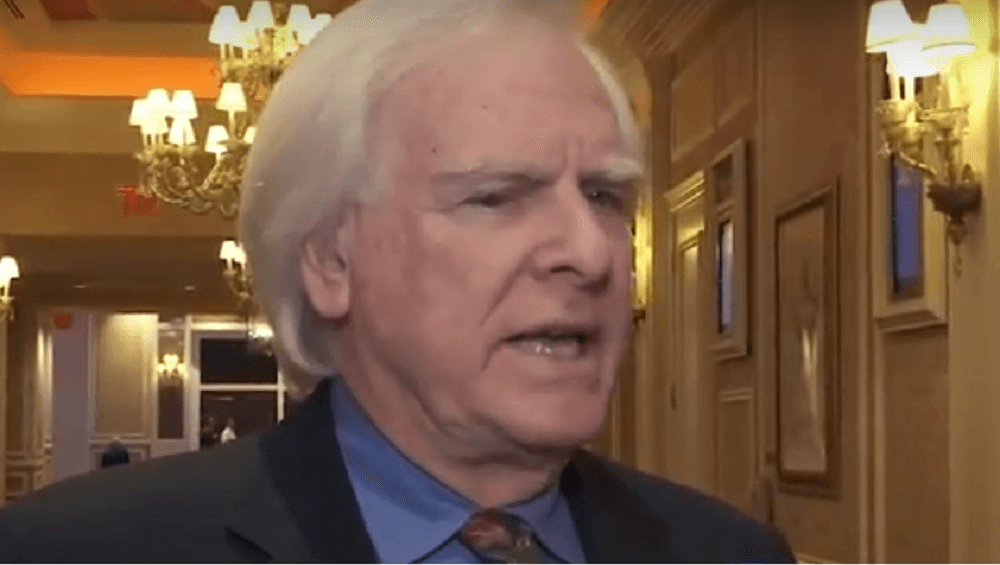

Writing in gamblingandthelaw.com recently, prominent gaming lawyer Professor I. Nelson Rose says the integrity fee may sound innocuous but it would be devastating for operators. He says in reality it amounts to a 25 percent tax on gross gaming revenue.

The fee would be one percent of handle – that’s all bets placed – rather than the amount won by the sports books, or gross gaming revenue.

Rose notes that the hold (win percentage for operators) in the sports books of Las Vegas is about 4.16 percent. That means a sports book with a handle of $10 million is in fact only producing gross gaming revenue of $416,000.

New York has a Plan

Using the tax numbers proposed by the Indiana bill, a sports book with a handle of $10 million would end up paying around $25,000 in federal tax, $38,000 in state taxes and $100,000, the most by far, to the leagues.

This would leave the operator with about $250,000 to pay all its expenses, including other taxes, such as property and income taxes, says Rose.

Meanwhile, LegalSportsReport has got wind of a draft bill doing the rounds in the New York state legislature that proposes a more sensible compromise with the leagues. It suggests a .25 percent integrity fee, capped at 2 percent of gross gaming revenue.

Lawmakers have yet to introduce the New York bill but is likely to appear within the next few months, said LSR.

No comments yet