Illinois Sports Betting Tax Resulting in Fewer Bets, More Revenue for State

Posted on: December 18, 2025, 11:45h.

Last updated on: December 18, 2025, 11:54h.

- Illinois’ per-bet tax is leading to reduced betting and more revenue for the state

- Other states unlikely to follow suit, says research firm

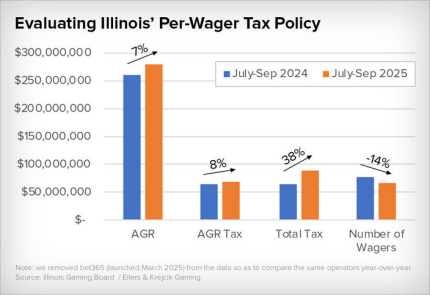

Acknowledging the data should be consumed with grains of salt, a research firm points out that since Illinois implemented its per-bet tax plan on internet sports wagering in July, the number of bets placed in the state has declined, but adjusted gaming revenue (AGR) rose.

In a new report, Eilers & Krejcik Gaming (EKG) points out that since the Illinois tax hike went into effect on July 1, and following per-wager transaction fees implemented by DraftKings and FanDuel, the two largest US sportsbook operators, the number of bets placed in the state has declined, but that hasn’t pinched collected revenue.

Last month, the Sports Betting Alliance (SBA) of Illinois said bettors in the state placed five million fewer wagers in September than they did a year earlier, signaling they’re not pleased with the tax or the transaction fees. Data from the Illinois Gaming Board (IGB), however, confirm that September tier-one and tier-two handle increased year over year.

Illinois Bettors Are Making Fewer Wagers, But …

It’s clear bettors in the Land of Lincoln are reducing volume in response to the tax hike, but revenue isn’t suffering because they’re increasing their bet size.

First, are noticeably fewer wagers this year: an unsurprising consequence of assessing a per-wager tax that is largely passed through to customers,” observes EKG. “Second, adjusted gaming revenue (AGR) still grew in line with the national gross gaming revenue (GGR) average (+8%), indicating that Illinois customers do not appear to have downwardly adjusted their wagering activity to account for the fees but are simply betting more per wager.”

Under the state’s online sports betting tax scheme, a levy of 25 cents per bet is applied on the first 20 million bets booked, with that figure doubling to 50 cents for every bet after 20 million.

That’s particularly onerous for DraftKings and FanDuel, which are the two largest operators in the state. Both responded by implementing per-bet transaction fees of 50 cents. Fanatics charges 25 cents per bet in Illinois, while other operators opted for increased minimum bet sizes.

Other States Won’t Copy Illinois, But OSB Taxes Will Rise

For now, Illinois appears to be having its cake and eating it, too. The number of bets placed is declining with no ill effects on collected revenue, but the latest tax increase may be compelling bettors to wager more, and that could be problematic down the road.

We do not necessarily see other states copying in the near term. For one, Illinois has essentially incentivized a higher stake per bet, which has potential negative RG ramifications,” adds EKG.

It’s been widely discussed that other states won’t copy the Illinois tax plan, but the trend for sports betting taxes is going in one direction: up. In addition to Illinois, Louisiana, Maryland, New Jersey, and Washington, DC boosted sports wagering taxes in 2025, and several other states proposed increases of their own.

No comments yet