Finance Guru Dave Ramsey Says Spouses of Gambling Addicts Must Make Clear Demands

Posted on: October 13, 2025, 01:35h.

Last updated on: October 13, 2025, 01:46h.

- Dave Ramsey says gambling addicts need ultimatums from their loved ones

- Sports betting is a major concern in the money world, Ramsey says

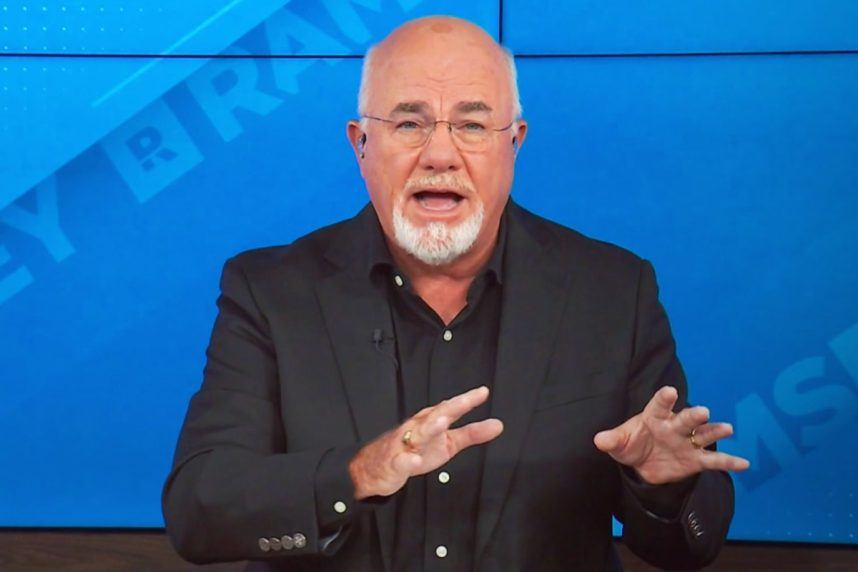

Dave Ramsey, the star of his namesake nationally syndicated finance radio show, recently heard from a 69-year-old caller who says her husband gambled nearly all of their retirement away on sports.

Telling her story under obvious emotional distress, the woman detailed that her 79-year-old husband has lost almost all of their $1 million retirement portfolio betting on sports.

Saying she only recently became aware that their savings were down to $15K, the woman told Ramsey she began looking into their finances after she found a late notice on their taxes in the mail.

Ramsey has been hosting “The Ramsey Show” for more than three decades. Among the most listened to radio shows in the US, the daily program airs from 2 pm to 5 pm EST on terrestrial radio and podcast outlets, as well as on iHeartRadio and SiriusXM.

Addicts Need Ultimatums

The woman’s husband, who told her he can stop betting at any time and pledged to “get it under control,” needs clear parameters, Ramsey said.

Call a marriage counselor and someone who does addiction counseling,” Ramsey advised. “Both can give you a framework by which you lead them into an ultimatum, and the ultimatum is: you stop cold turkey, you are going to Gamblers’ Anonymous, and you are going to a therapist.”

Ramsey said that she needs to tell her husband that if he gambles another dime, “You will not see me anymore.”

Ramsey has long warned listeners about sports betting.

Sports betting is probably the fastest growing addictive problem that we’re running into in the money world,” Ramsey said during a February show. “It’s out of control, sports betting. You can bet on anything, and they [addicts] are betting on everything. Some of you are losing your entire futures betting on someone else earning a living.”

An April report on Ramsey’s website — Ramsey Solutions — said one’s “odds of getting rich off sports betting apps are low.”

“It takes a huge bankroll to actually make money long term. You’d have to bet hundreds of thousands of dollars a year to see any kind of real money from it,” wrote Ramsey Solutions finance expert George Kamel.

“Don’t use betting on the big game as an investment plan — no matter how much Big Rick with the cheese on his head at the Packers game says you should. Smart investors who want to build wealth the right way don’t gamble on sports betting. They keep their investments diverse in the market and have a long-term mindset,” Kamel continued.

Problem Gambling Rate Softens

In July, the National Council on Problem Gambling (NCPG) released a national survey suggesting that the spike in risky gambling behavior observed during and after the COVID-19 pandemic has somewhat subsided.

The National Survey on Gambling Attitudes and Gambling Experiences found that nearly 20 million American adults reported at least one problematic gambling behavior “many times” in the past year. That’s down from 27.5 million in 2021, though that level remains elevated compared with 2018.

“This new research shows that the nationwide efforts in responsible gambling and public awareness are making a positive impact, but the work is far from over,” said Derek Longmeier, NCPG president. “We must build on this momentum by embedding problem gambling into the broader public health infrastructure and investing in what we know works: collaboration across prevention, education, treatment, and research with the support of the government and communities.”

Last Comment ( 1 )

Dave Ramsey knows very little about recovery from gambling addiction. Folks who have achieved recovery from gambling chaos through the 12-step fellowship of Gambling Anonymous (nearly all if them) know that any ultimatum to a problem gambler that includes the words "you stop cold turkey, you are going to Gamblers’ Anonymous" is probably the very worst ultimatum possible. Anyone telling a chronic substance abuser, " You will just stop cold turkey!" is living in a dream world with zero knowledge about achieving recovery . Demanding that the gambler attends Gamblers Anonymous will only gain you that "X" in the block in that same dream world. The only requirement for Gamblers Anonymous membership is the desire to stop gambling. Reread that requirement several more times or until you understand every word of it. Finally hears a pro tip: If a compulsive gambler in active addiction ever hears an ultimatum that begins with "If I ever find out you are gambling again...." just know right then that you will NEVER find out.