Golden Entertainment Going Private, Vici Buying Three More Vegas Casinos

Casino sales: Exciting. Operator of a diversified entertainment platform of gaming and hospitality assets (including Strat) doing a sale leaseback deal: Boring AF.

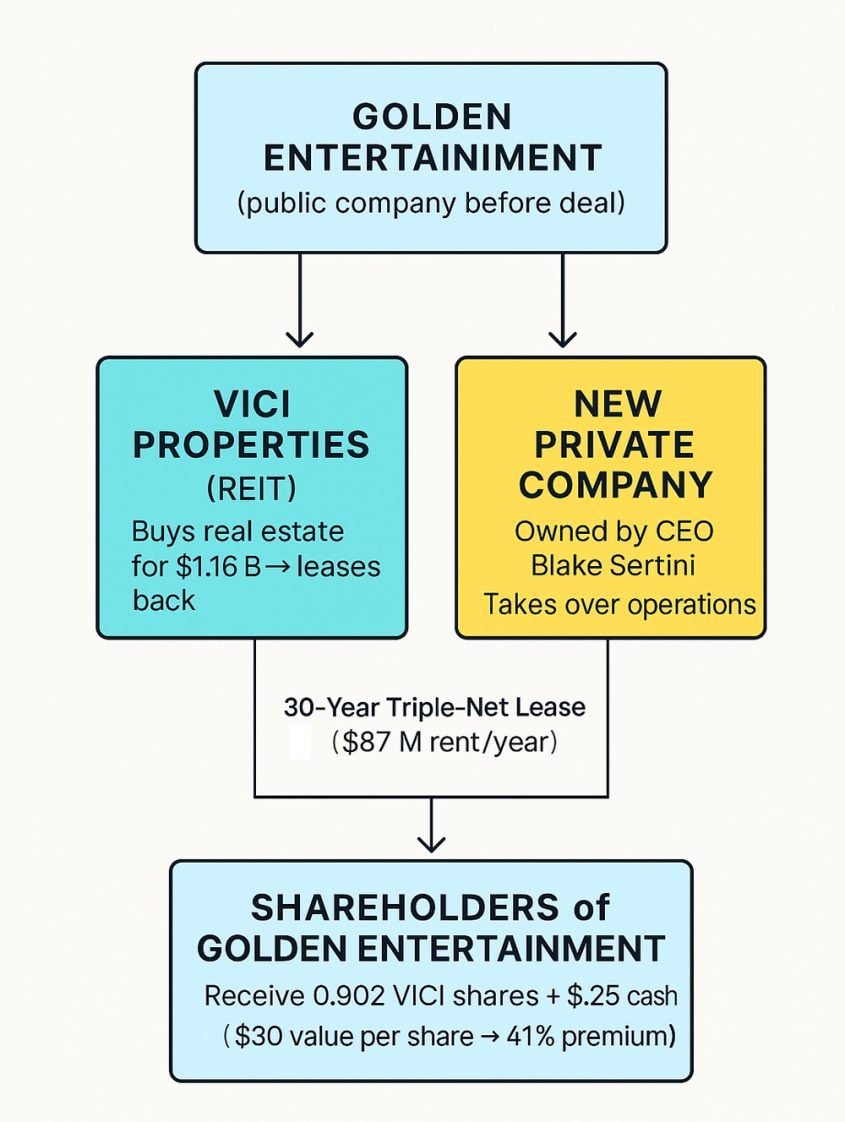

Golden Entertainment, Inc. has agreed to be acquired by its CEO, Blake Sartini, and will enter a sale-leaseback transaction with Vici Properties Inc., which will purchase the real estate of The Strat and two Arizona Charlie’s casinos in Las Vegas.

See? That wasn’t too excruciating. We’re here to make the boring AF marginally less so! Let’s get this yawnfest started!

So, Golden Entertainment has been struggling. They didn’t include that in their news release about the sale of Golden’s operations to Blake Sartini (the company’s founder and CEO), but that’s the case.

The recent news wasn’t a “fire sale,” per se, but rather an indication of headwinds.

The headwinds were declining revenue, margin pressure and high debt/leverage risk.

As we’ve shared, Golden has been weighed down by Strat and it’s been quietly for sale for some time.

For Q3 2025, Golden reported revenue of $154.8 million, down from $161.2 million the same quarter the year before. In that same quarter, Golden reported a net loss of $4.7 million, compared to a net income of $5.2 million the year before. Adjusted EBITDA (a key measure of operating performance) fell from about $34.0 million to about $30.5 million year-on-year.

In an earlier investor presentation (in August 2025) somebody even said the company’s “real estate value may exceed enterprise value” and thus “sale-leaseback” deals were in the works.

Fast forward to today.

Golden Entertainment is being taken private. As mentioned, the company’s operating business will be acquired by a new private‐company controlled by Blake Sartini (the Chairman & CEO of Golden).

Operations and physical assets are often two very different things on The Strip these days. Casino companies own the operations, Vici (a REIT) owns the land and buildings.

Coincidentally, Vici will acquire the real estate of seven of Golden’s casino properties in Nevada for approximately $1.16 billion.

We only care about three of them because they are located in Las Vegas: The Strat, Arizona Charlie’s Decatur and Arizona Charlie’s Boulder (hereinafter referred to as “dumps”).

We kid because we love! They’re local grind joints. Strat is really the big deal here.

Oh, the other casinos involved with Vici acquiring land are Aquarius Casino Resort & Edgewater Casino Resort in Laughlin, NV; Pahrump Nugget Hotel & Casino and Lakeside RV Park & Casino, both in (wait for it) Pahrump.

Golden missed its revenue and earnings forecasts, time to shake things up.

Vici will lease back to Sartini’s new operating company, Golden OpCo, the casinos in question on a 30-year triple-net master lease (with four 5-year renewal options). The initial annual rent is about $87 million. Rent goes up 2% annually from lease year three onward.

Something something stockholders blah blah. We’re exhausted from all the plain English, so let’s hear directly from the news release about the blah blah: “Golden stockholders will receive total consideration of a fixed exchange ratio of 0.902 shares of VICI common stock for the sale of seven casino real estate assets and a cash distribution with proceeds from Blake Sartini of $2.75 for each share of Golden stock held at the closing of the transaction. The $30.00 value of consideration at signing represents a 41% premium to Golden’s closing share price on November 5, 2025. The Company will continue to pay shareholders regular quarterly cash dividends of $0.25 per share through the close of the transaction.”

There are people who have to look at this mind-numbing blather day in and day out. As their job. We gamble and make snarky jokes on Twitter.

Why does this deal make sense for those involved?

Adding seven assets to Vici’s portfolio gives it more scale in Nevada, particularly the Las Vegas locals market (which is large, stable). The rent structure (7.5% cap rate, long lease) provides predictable long‐term cash flows. It diversifies their portfolio within Nevada, where regulatory/tax environment is favorable.

Vici isn’t having the best year, ever. The company’s stock has tanked 12% in just the past three months.

Investors are nervous about the fact 40% of Vici’s annual base rent comes from one casino company, Caesars Entertainment. It’s a long, even more boring story, but Vici is a spin-off of Caesars Entertainment, and they have a lot of eggs in the Caesars basket.

Hence the importance of diversifying their portfolio.

On the Golden side, by selling the real estate and leasing it back, Golden unlocks value in its land and physical assets, reduces capital tied up in real estate and can go private, which tends to make companies more nimble and responsive to changing market conditions. Going private also reduces the public company reporting burdens.

Worth noting: As part of the deal, Vici will assume and repay up to $426 million of Golden Entertainment’s outstanding debt.

The whole REIT sale-leaseback thing is common in Las Vegas now. Vici is the Strip’s landlord. When people talk about Caesars or MGM Resorts “owning” most of the casinos on The Strip, it’s fake news.

Casinos own databases, Vici owns the real estate. (You know, the valuable part that increases in value over time.)

The “asset light” strategy of casino companies is awesome if revenue increases, but rents increase whether revenue does. That was always a hilariously silly suggestion until Las Vegas tourism started dropping in 2025. At which point much of the laughing stopped.

Caesars and MGM say everything’s fine, nothing to see here, but everyone’s nervous, no matter what they’re saying on earnings calls.

Vici is diversifying, Golden is restructuring to reduce risk and reposition itself.

What does all this mean to Strat guests? Nothing. It’s bookkeeping.

Yes, we just wasted 14 minutes of your time.

The good news is that you grasp any of what we just shared, you will be the most informed person in your squad or posse or whatever group of people you choose to chill with.

The Golden/Vici deal is expected to close in mid-2026.

Fun fact: Blake Sartini is married to Delise Fertitta, daughter of Frank Fertitta Jr. and the sister of casino moguls and billionaires Frank and Lorenzo Fertitta.

Let’s just say if Sartini needs a little extra cashy-cash to ensure this deal gets done, he’s covered.

Leave your thoughts on “Golden Entertainment Going Private, Vici Buying Three More Vegas Casinos”

7 Comments