Omnibus Spending Bill to Ban Military Charge Card Use in Casinos and Strip Clubs

Posted on: March 24, 2018, 10:00h.

Last updated on: March 24, 2018, 10:02h.

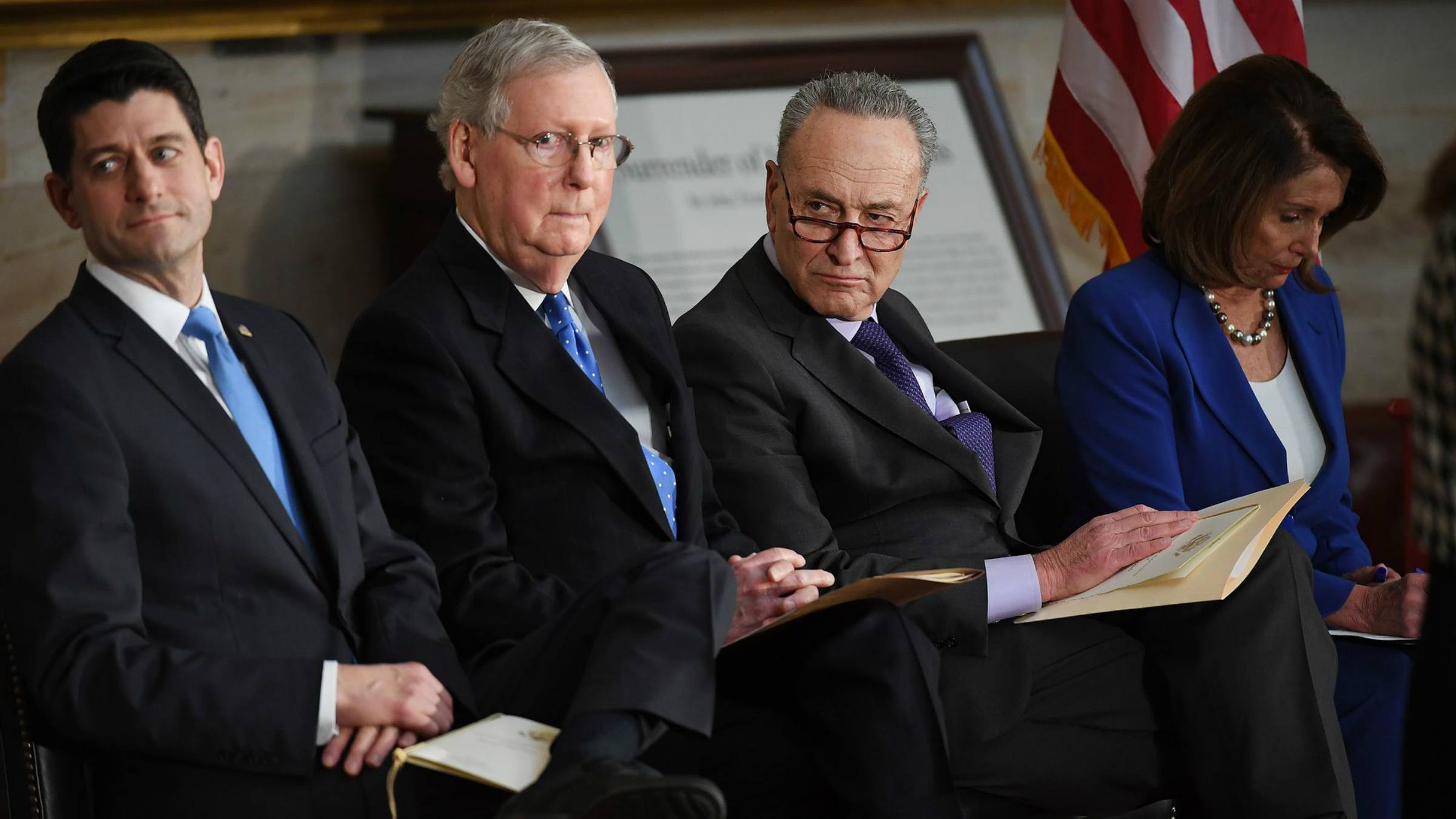

The 2018 omnibus spending bill passed by Congress this week includes a provision that would explicitly ban military members from using Defense Department charge cards inside casinos and strip clubs.

The Defense Department says such use is already prohibited, but a 2015 report from the agency’s own inspector general found that $952,258 was charged on government credit cards inside casinos during a 12-month period ending June 30, 2014. An additional $96,576 was spent at strip clubs.

The massive 2018 Appropriations Act, which is 2,300 pages long, further clarifies that those who use the military charge cards in unauthorized ways are breaking the law.

“The bill mandates that the travel charge cards may not be used “for gaming, or for entertainment that includes topless or nude entertainers or participants.”

The DoD inspector general report found the government cards were used 4,437 times at casinos and 900 adult entertainment transactions were completed during the 12-month period.

President Donald Trump had threatened to veto the $1.3 trillion omnibus spending bill. In a Friday tweet, the president explained, “800,000 plus DACA recipients have been totally abandoned by the Democrats (not even mentioned in Bill) and the BORDER WALL, which is desperately needed for our National Defense, is not fully funded.”

However, Trump signed the measure Friday afternoon.

Travel Expenses Only

Military members traveling are already prohibited from using the state-issued cards for personal expenses. According to the Department of Defense (DoD), “The use of the travel card for non-official expenses may result in disciplinary actions.”

The cards are to be used only for official travel expenses, and are issued to those employees who meet certain requirements including a minimum credit score of 660. The cards have a monthly credit limit of $7,500.

Nate Christensen, former head of public affairs for the US Navy, said in 2015 that “personal use of the card does not constitute payment, or reimbursement, of federal taxpayer dollars. The card holder must pay the cost of the unauthorized or personal use of transactions out of pocket.”

There are, of course, numerous reasons why a military member might wish to use his government charge card at a casino or strip club over his personal account that might be shared with a husband or wife.

The Washington Post journalist Dan Lamothe reports the account of one civilian employee at the Defense Threat Reduction Agency. The repeat charge card offender stated in a government investigation that “he thought personal use was acceptable as long as the bill was paid.”

The unnamed violator made ATM withdrawals at casinos in West Virginia and Colorado totaling $609 in 2014. He only received a letter of reprimand from the DoD, but was later placed on administrative leave after he was discovered to have continued violating the charge card rules.

Leveling Charges

The omnibus spending bill provision regarding improper military charge card use does not dictate what penalties should be levied against ongoing violators. It’s difficult, if not impossible, to determine how much of the nearly $1.1 million in unauthorized charges funded by taxpayer money was reimbursed by those who swiped the cards.

In a 2016 audit, Defense Department Principal Inspector General Glenn Fine explained, “DoD management did not perform reviews … of cardholders when notified that cardholders potentially misused their travel card at casinos and adult entertainment establishments.”

Fine concluded, “DoD experienced potential national security vulnerabilities due to the lack of adjudication for cardholders with possible security concerns including, extensive travel card misuse, questionable judgment, the decision not to follow rules and guidance, financial concerns, or gambling addictions.”

No comments yet