Novig Raises $18 Million in Series A Funding Round

Posted on: August 12, 2025, 01:41h.

Last updated on: August 12, 2025, 01:55h.

- Five investors participated in capital raise

- Novig operates a peer-to-peer sports prediction market

Novig, the operator of a US peer-to-peer sports prediction market, announced it raised $18 million in a Series A funding round, the latest sign institutional investors are willing to allocate capital to the gaming/sports wagering space.

The New York-based company said Forerunner led the capital raise while existing investors Gaingels, NFX, Perceptive Ventures, and Y Combinator also participated. Novig said it plans to use the fresh funding to add more sports to its offerings and fortify its footprint in existing markets.

“With the new capital, Novig plans to expand coverage to additional sports and deepen its presence in existing markets,” according to a press release. “The company will also launch new features, including leaderboards, group contests, and head-to-head trading. Additionally, Novig aims to support fiat on-ramps such as debit and credit card payments, launch a full-featured web app, and scale hiring across its engineering, product, and growth teams.”

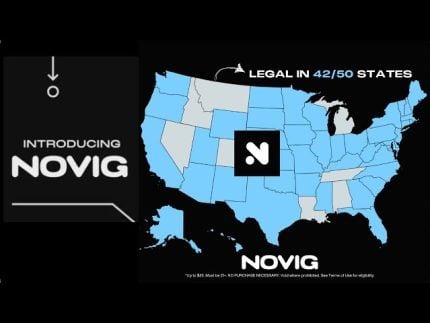

Founded by Jacob Fortinsky and Kelechi Ukah, Novig is available in more than 40 states, including California and Texas, neither of which currently permits traditional sports wagering. The company lists 11 investors on its website.

Investors Eager to Access Startup Wagering Firms

Novig is the latest example of the institutional investor/venture capital floodgates being open to iGaming and sports wagering-related companies.

In late July, social casino operator MyPrize announced that it raised $21 million at a valuation of $250 million. Earlier that month, Matthew Berry’s Fantasy Life announced a $7 million capital raise in what was its second funding round.

Of added relevance to Novig is the fact that investors are showing little hesitancy regarding prediction market operators. In June, Kalshi raised $185 million, pushing its valuation to $2 billion while rival Polymarket is rumored to be close to raising $200 million, which values the firm at $1 billion, putting it in the illustrious unicorn camp.

“Novig sits at the center of several key secular trends in gaming and entertainment, namely that consumers increasingly are spending their time, energy, and attention with financial products,” said Fawzi Itani, Principal at Forerunner. “The Novig team brings the most sophisticated and nuanced perspective to sports prediction markets. They not only deeply understand their target customer, but are building a system that is more fair, community-oriented, rewarding, and well, fun.”

Novig Avoids Some Prediction Markets Controversies

Although it focuses on sports, Novig avoids some of the controversies associated with traditional prediction firms like Kalshi. For example, Novig isn’t operational in all 50 states.

Additionally, the company’s peer-to-peer model means clients are competing against each other, not against the house, as is the case with standard sports betting. That doesn’t necessarily imply Novig is free of regulatory scrutiny, but it’s clear the peer-to-peer methodology is Novig’s point of emphasis.

“More than 90% of trades on Novig are now fully peer-to-peer, a signal of strong product-market fit,” the company added in the statement. “Novig users are three times more likely to remain active on the platform compared to traditional betting platforms. Every new Novig user receives a starting balance of Novig Coins and Novig Cash, enabling them to experience the thrill of trading with no upfront deposit or risk.”

The platform has a free-to-play offering as well as one where users deploy Novig Cash that can be used for prizes and real money redemptions if they win their wagers.

No comments yet