Kalshi Volume Beats Election Day, Robinhood Handles 2B+ Event Contracts in Q3

Posted on: September 29, 2025, 04:10h.

Last updated on: September 29, 2025, 04:11h.

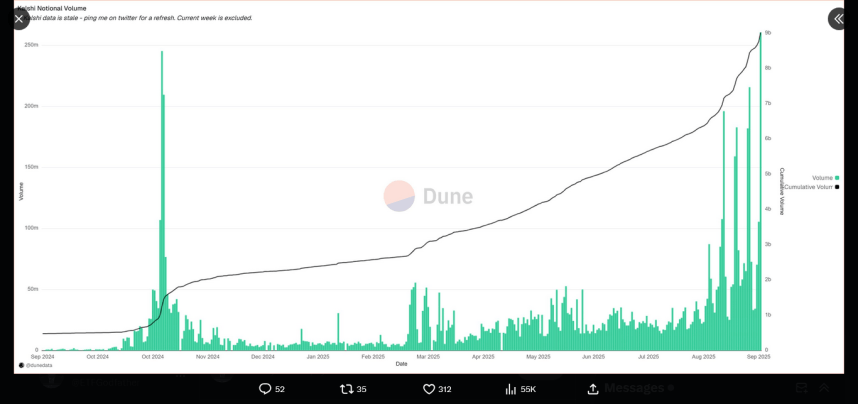

- Due in large part to NFL contracts, Kalshi volume broke Election Day record

- Robinhood says it passed four billion even contracts handled with more than half processed in current quarter

Historically, football season has been a boon for sportsbook operators. This year, that trend is matriculating over to prediction markets in significant fashion.

On Sunday, volume on Kalshi reached $260 million over 763,000 event contracts. CEO and co-founder Tarek Mansour took to X, confirming it was a record day for the yes/no exchange operator, indicating that the trend of football being the most bet on sport in the US is highly relevant in prediction markets.

Last night, Kalshi’s daily volume has officially surpassed Election Day,” wrote Mansour. “Nothing beats football in America.”

Football success realized by Kalshi, Polymarket and other prediction market operators is likely sending a loud message to traditional sportsbook operators. Kalshi and its competitors largely rose to prominence as the primary avenues for “investing” in the outcome of the 2024 presidential election — political wagers are prohibited at US sportsbooks — and those companies are now toppling that volume in just the fourth week of the NFL season. That implies prediction market football volume will increase as more big games hit the schedule.

Robinhood Benefiting, Too

Shares of Robinhood Markets (NASDAQ: HOOD), a Kalshi partner, surged 12.27% today on above-average volume, racing to an all-time high after CEO Vlad Tenev has processed more than four billion event contracts with more than half that tally coming the current quarter.

Tenev’s update arrived less than a week after an analyst estimated, based on month-to-date figures, Robinhood’s yes/no derivatives business could be worth $200 million or more annually to the company’s top-line. The trading platform is a major driver of Kalshi volume accounting for 25% to 35% of the prediction market’s turnover on any given day.

Robinhood commenced offering football derivatives this season. Under the terms of its partnership with Kalshi, the two companies equally split the transaction fees paid by Robinhood clients to purchase those event contracts.

Kalshi NFL Pricing Work in Progress

One of the areas in which prediction markets can make headway against sportsbooks is by offering bet pricing on NFL games. There is some evidence that’s taken place this season, but not in dominant, consistent fashion.

In Monday report to clients, Citizens Equity Research analyst Jordan Bender noted that on Friday, Sept. 26, Kalshi’s pricing on NFL money lines and over/unders was worse when factoring transaction fees than what was found on DraftKings and FanDuel. There are signs the gap is narrowing, but prediction markets have some work to do on the pricing front.

“Despite some in the industry pushing the notion that exchanges have better pricing, this is currently not true for the average consumer, according to the data we track throughout the NFL season,” observes Bender. “The NFL season should be some of the most liquid sports markets for Kalshi all year, excluding tentpole events, as we believe these games have the highest wagering per game across any league in the U.S. If we see the spread starting to tighten more, it implies the model is working (higher liquidity) and Kalshi is offering fewer incentives to market makers. In our view, the spread should narrow as user adoption (and liquidity) improves throughout the football season.”

No comments yet