Areas of Expertise

5361 stories by Todd Shriber

Wynn Resorts Doling out $14.5 Million in Stock to Retain Execs, Other High-Level Employees

Wynn Resorts (NASDAQ:WYNN) said the compensation committee of its board of directors signed off on issuing 176,247 shares of stock to retain 240 employees, including named executives through the end of this year and well into 2021. The Encore operator revealed the...

Melco Resorts Still Keen on Japan IR Project Even as Rivals Bail

Melco Resorts & Entertainment (NASDAQ:MLCO) CEO Lawrence Ho reiterated his company's commitment to Japan on the operator's second-quarter earnings conference call Thursday. It's an affirmation that comes after some rivals ditched the Land of the Rising Sun. Ho's comments were made on...

Esports Entertainment Group Launches Higher on Twin River New Jersey Deal

Esports Entertainment Group, Inc. (NASDAQ:GMBL), a tiny online gaming and sports betting company vaulted higher Thursday after it entered into a multi-year agreement with Twin River Worldwide Holdings (NYSE:TRWH) to be that operator's sports wagering partner in New Jersey. Up more than...

IAC Chairman Barry Diller, CEO Joey Levin Join MGM Board of Directors

IAC/InterActiveCorp (NASDAQ:IAC) Chairman Barry Diller and CEO Joey Levin are taking two seats on the MGM board of directors, expanding that lineup from 12 to 14. The appointment stems from a $1 billion investment in MGM Resorts International (NYSE:MGM) announced on Aug....

GAN Reveals Penn Interactive as New Client, Stock Soars Again

GAN Ltd. (NASDAQ:GAN), the maker of cloud computing software for the gaming industry, is soaring again Thursday after the British company said Penn National Gaming's (NASDAQ:PENN) Penn Interactive unit is a new client. Penn's mychoice social casino app will be powered by...

IGT Gets Boyd Bounce on Enhanced Sportsbook Deal with Gaming Company

International Game Technology (NYSE:IGT) rallied in Wednesday's after-hours trading session on news of an expanded sportsbook relationship with Boyd Gaming (NYSE:BYD). Shares of the UK-based gaming technology company were up more than four percent at one point during the after-market session before...

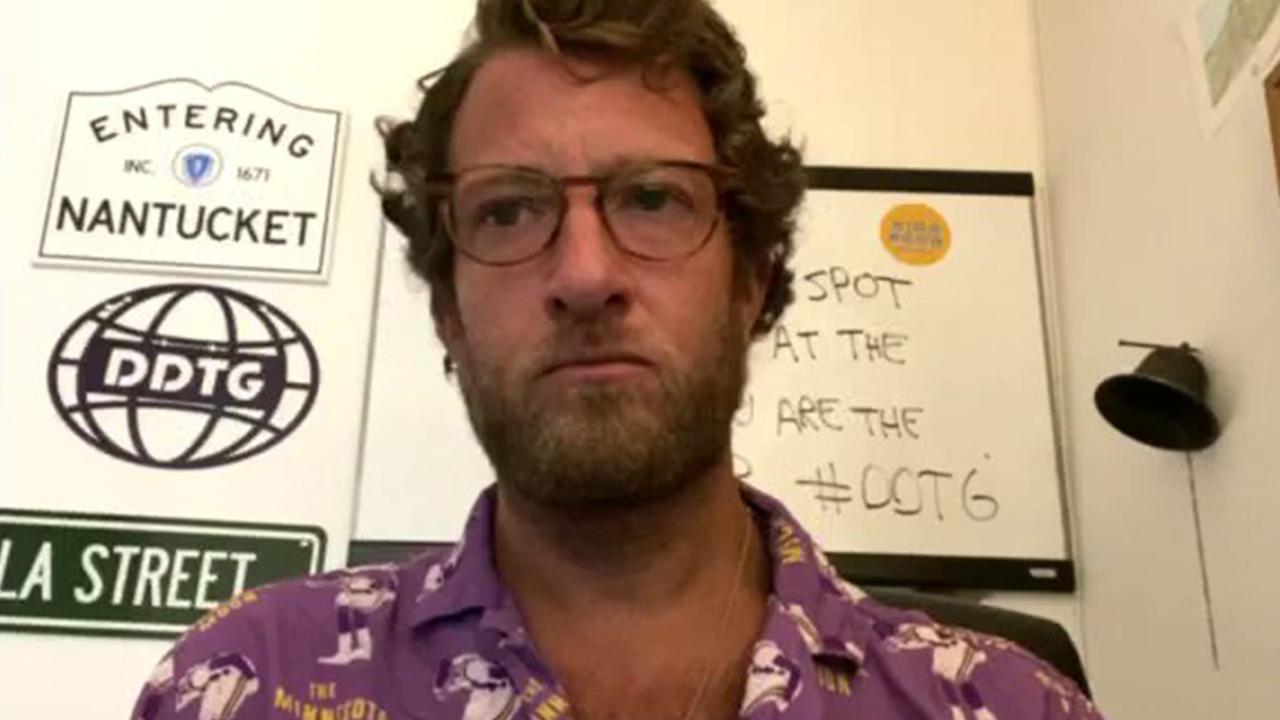

Penn National Stock Drops with Portnoy COVID-19 Speculation

Penn National Stock shares slid Wednesday after BarStool's David Portnoy posted a video speculating that he might have coronavirus, underscoring just how intimately correlated the fortunes of Penn National Gaming (NASDAQ:PENN) stock is to the success of the company's relationship with Barstool...

Wynn Macau Says WeChat Ban Could Have Adverse Impact, Trims Daily Operating Costs to $2 Million

In a filing with the Hong Kong Stock Exchange, Wynn Macau tells investors increasing geopolitical tensions between the US and China, including the Trump Administration's recent ban of the popular Chinese messaging app WeChat, could hamper the gaming company's business. The operator...

William Hill Should Be Viewed as Growth Stock, Says Jefferies Analyst

William Hill (OTC:WIMHY) is trading higher by more than 10 percent Tuesday after Jefferies analyst James Wheatcroft lifted his price target on the British bookmaker's London-listed shares to 330 pence from 305 pence. The price is more than double where the stock...

Boyd Gaming Eldorado Casino Will Remain Shuttered Through June 2021

Boyd Gaming's Eldorado Casino in Henderson, Nev. will remain closed through June 2021, after the company requested a non-operational license from the city council. Boyd operates 29 casinos in 10 states, including a dozen in Las Vegas. Between May 20 and July...