Latest Casino and Gaming Industry News

National Council on Problem Gambling Has Grave Concerns About Prediction Markets

The National Council on Problem Gambling wants prediction markets to be 21+ Currently, anyone aged 18 and older can trade...

— February 20, 2026

Texas Mayor Arrested After Gambling Machines Found in Laundromat

— February 20, 2026

Palms Casino in Vegas Sued for Failing to Prevent Child Sex Trafficking

— February 20, 2026

Caesars Planning Drinks on the Sand With New Atlantic City Beach Bar

— February 20, 2026

DraftKings, Flutter Among Top Consumer Cyclical Stocks to Buy, Says Morningstar

— February 20, 2026

Most Recent

Happy Valley Casino in Pennsylvania Enticing Customers With Free Slot Play

— February 20, 2026

Wisconsin Online Sports Betting Inches Closer With State Assembly Approval

— February 20, 2026

TV Producer’s $13 MGM Grand Candy Bar Video Becomes His Biggest Hit Yet

— February 19, 2026

Asia Pacific Gaming

Polymarket Targets China With Lunar New Year Bets

— February 18, 2026

China Embassy’s Gambling Warning Sparks Debate Over Alleged Suicide Story

— February 16, 2026

Melco Resorts Ends Strategic Review of Manila Casino

— February 13, 2026

Stanley Ho Named in Epstein Files, Included in Testimony

— February 11, 2026

Financial

DraftKings, Flutter Among Top Consumer Cyclical Stocks to Buy, Says Morningstar

— February 20, 2026

Boyd Gaming Back with Another Dividend Hike

— February 19, 2026

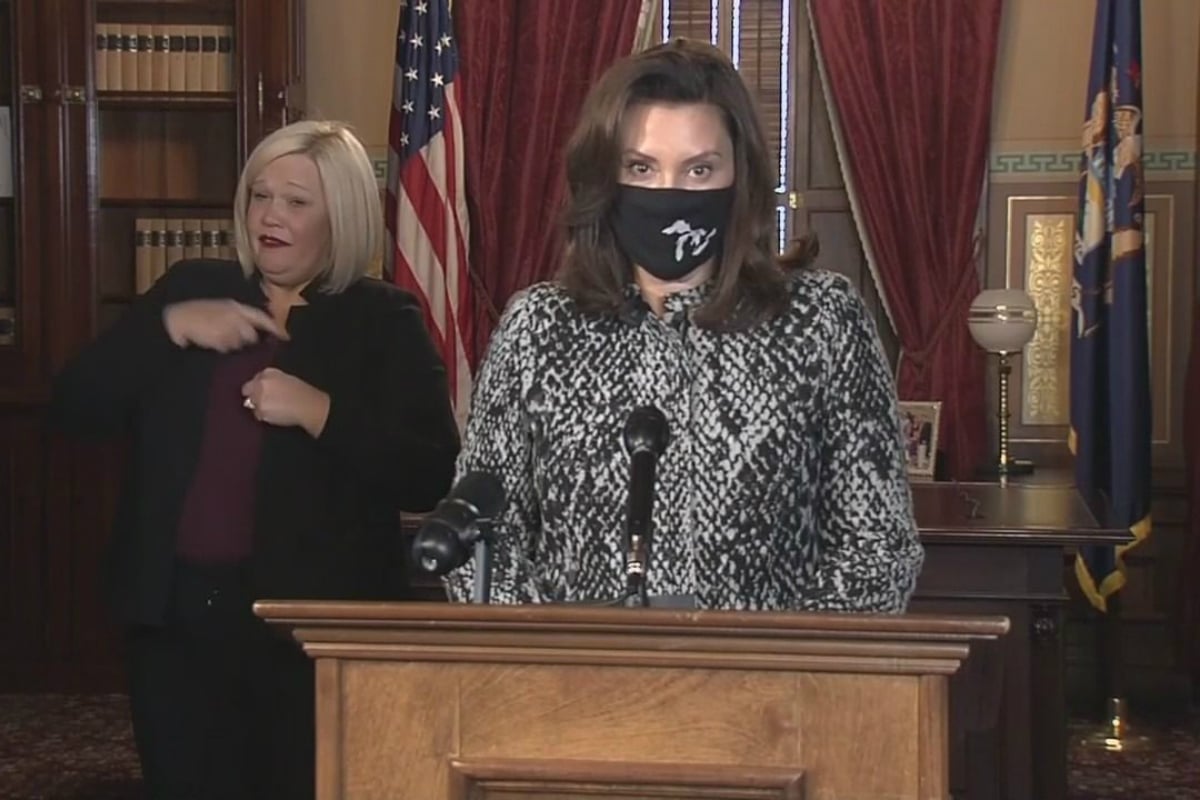

Michigan Most Likely State to Raise iGaming, Sports Betting Taxes in 2026

— February 19, 2026

Las Vegas

Palms Casino in Vegas Sued for Failing to Prevent Child Sex Trafficking

— February 20, 2026

TV Producer’s $13 MGM Grand Candy Bar Video Becomes His Biggest Hit Yet

— February 19, 2026

Boyd Gaming Back with Another Dividend Hike

— February 19, 2026

Most Popular

New Casino Near Las Vegas Set to Open Next Month in Henderson

— February 8, 2026

Impaired Vegas Club Promoter Mows Down UK Mom and Toddler Near Strip, Flees

— February 10, 2026

Illusionist ‘Shaun Mistery’ Gets 10 Years After Multi-State Casino Scam Rampage

— February 12, 2026

North Las Vegas Casino That Shuttered Last Year Announces Reopening, New Name

— February 12, 2026

Most Commented

-

Wynn Coverup: Nightlife Exec Allegedly Took Liquor Company Kickbacks

— January 20, 2026 — 16 Comments -

Wynn Facing Fed Probe Tied to VP’s Alleged Liquor Scheme

— January 22, 2026 — 13 Comments -

Catawba Two Kings Casino NOT Planning Thoroughbred Racetrack

— February 4, 2026 — 8 Comments -

EXCLUSIVE: How Parimatch VIP Players Were Moved After Ukraine’s 2023 Sanctions

— January 12, 2026 — 7 Comments -

Turning Point Super Bowl Half-Time Show Draws Over 5 Million Viewers

— February 8, 2026 — 6 Comments

Most Read

Final Super Bowl Injury Update: Drake Maye Cleared To Play

— February 7, 2026

Las Vegas Man Arrested for $1 Million Extortion Plot Targeting Steve Wynn

— February 10, 2026

All Casino and Gaming Industry News

Illinois Advances Bill to Prevent Chicago Sports Betting Tax Hike

— February 19, 2026

Boyd Gaming Back with Another Dividend Hike

— February 19, 2026

Woman Arrested for Abandoning Puppy at Vegas Airport

— February 19, 2026

Michigan Man Guilty of Murder in No-Body Killing of ‘High-Stakes’ Poker Player

— February 19, 2026

Full Steam Ahead for PointsBet Alberta Despite AGCO Suspension

— February 19, 2026

Michigan Most Likely State to Raise iGaming, Sports Betting Taxes in 2026

— February 19, 2026

MGM National Harbor Sphere Would Offset Tax Losses From NFL Commanders Exit

— February 19, 2026

Traders: Trump’s White House UFC Bash Will Be a Betting Boom

— February 19, 2026

Casino-Banned Las Vegas Pimp Accused of Attempted Child Kidnap

— February 19, 2026

Caesars Says ‘No’ to Prediction Markets…For Now

— February 19, 2026

Kalshi, Tradeweb Team Up to Expand Institutional Access to Prediction Markets

— February 19, 2026

Sports Betting Fight Renews in South Carolina, But Effort Faces Long Odds

— February 19, 2026

Clase Gambling Trial Likely Pushed to October

— February 19, 2026