Prosecutor: New Jersey Accountant Stole $1.64 Million to Fund Sports Betting Habit

Posted on: February 2, 2026, 07:52h.

Last updated on: February 2, 2026, 07:52h.

- An accountant in New Jersey is accused of stealing money from two clients

- State prosecutors allege the accountant used some of the illicit funds to cover his sports bets

The New Jersey Attorney General’s Office has charged an accountant on the claims that he stole from two businesses that hired him. Much of the money, prosecutors allege, went to fund his sports betting addiction.

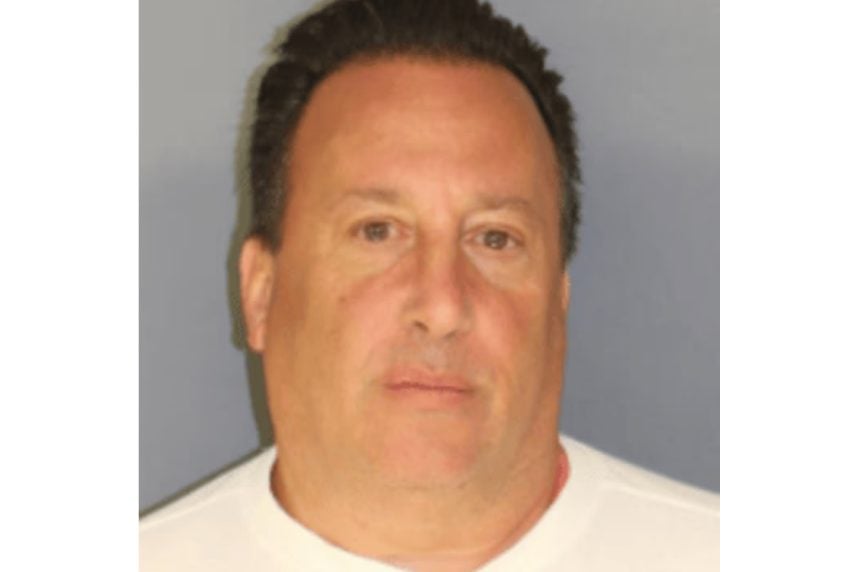

NJ Acting Attorney General Jennifer Davenport and the Division of Criminal Justice charged Michael Delia, 61, of West Orange, with two counts of second-degree theft by unlawful taking, one count of second-degree money laundering, and one count of second-degree failure to turn over collected tax.

The defendant in this case is accused of violating his trust as the accountant and bookkeeper for two companies, lining his pockets at their expense and at the expense of the people of New Jersey. This conduct will be prosecuted to the fullest extent of the law,” said Davenport.

The charges come with the possibility that Delia could spend decades in prison if found guilty. Each second-degree felony charge carries a sentence of five to 10 years in state prison, and a fine of up to $150,000.

Sports Betting Habit

Charging documents allege that Delia funneled collected tax money from the two businesses he worked for as an accountant and bookkeeper to personal and corporate bank accounts he controlled.

An investigative financial analysis concluded that Delia used the funds for his personal benefit, including credit card bills, mortgage payments, and sports betting. From January 2020 through July 2023, state prosecutors allege Delia swindled $910,545 in taxes and issued himself checks from the companies totaling $733,313, for a grand theft of $1,643,385.

As an accountant and bookkeeper, Delia was responsible for remitting taxes from the two undisclosed businesses to the New Jersey Treasury. For the 2023 tax year, state officials allege that Delia diverted more than $126K in sales taxes from the two businesses to his personal accounts.

The US Office of the Inspector General and Small Business Administration assisted in the investigation.

Sports Betting Causing Addiction Concerns

As Casino.org reported last year, scholastic, mental health, and responsible gaming researchers across the country continue to voice concerns that the proliferation of legal sports betting is resulting in a surge in problem gambling.

A study from the University of Massachusetts School of Public Health and Health Sciences concluded that the number of gamblers experiencing gambling-related financial harms nearly doubled between 2022 and 2024.

The American Gaming Association boasts that legal sportsbooks won more than $15 billion from bettors from January through November 2025, the most recently reported month. That’s a 17.4% increase on the 11 months in 2024.

The gaming trade group projects that regulated oddsmakers will take $1.76 billion in legal wagers on this Sunday’s Super Bowl LX. That’s up from the AGA’s $1.39 billion projection for the big game last year.

No comments yet