Novig Drawing Takeover Interest, Including From Kalshi, Polymarket

Posted on: September 26, 2025, 09:51h.

Last updated on: September 26, 2025, 10:42h.

- Various suitors, including Kalshi and Polymarket, have expressed interest in potentially buying Novig

- Unknown if formal offers were made

- Novig runs a peer-to-peer prediction exchange

Novig, the operator of a US peer-to-peer sports prediction market, is reportedly garnering takeover interest from various companies, including larger rivals Kalshi and Polymarket.

Front Office Sports broke the story, reporting that “multiple suitors,” including Kalshi and Polymarket, have in recent weeks kicked the tires on buying Novig, but it’s not clear if offers were made. Citing an unidentified source familiar with the matter, the publication adds Novig isn’t actively shopping itself.

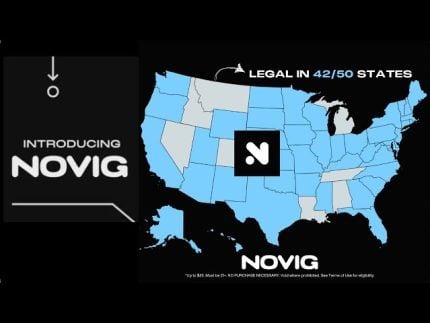

Founded by Jacob Fortinsky and Kelechi Ukah, Novig is available in more than 40 states, including California and Texas, neither of which currently permits traditional sports wagering. Last month, the company announced it raised $18 million in a Series A funding round. That capital raise was led by Forerunner with participation from existing investors Gaingels, NFX, Perceptive Ventures, and Y Combinator.

Novig Takeover Interest Credit to the Company

Assuming the report that bidders are interested in Novig is accurate, it’s arguably a credit to the company because it launched publicly just a year ago.

As a result, it’s one of the smaller players in the prediction markets space. According to data from Dune Analytics, the top prediction markets as of last week, as measured by weekly notional volume, were Kalshi, Polymarket, Limitless, and Myriad. Largely dominated by Kalshi and Polymarket, that quartet also leads across other metrics, including open interest, overall volume, weekly transactions, and weekly users.

Despite its lack of size relative to Kalshi and Polymarket, Novig could make for a credible takeover target for multiple reasons, including the desire of gaming companies to possibly enter the event contracts arena. FanDuel owner Flutter Entertainment (NYSE: FLUT) already announced a related move, prompting analysts and investors to speculate it’s just a matter of time before rival DraftKings (NASDAQ: DKNG) does the same.

Front Office Sports reports “other companies” have expressed interest in Novig, but those firms weren’t identified in the article.

Novig Has More Selling Points

For gaming and prediction market suitors alike, Novig offers other sources of attraction, including the fact that its contracts revolve entirely around sports. Unlike Kalshi and Polymarket, Novig doesn’t offer derivatives on financial asset prices, economic data, or pop culture events.

Additionally, Novig’s peer-to-peer model, under which clients compete against each other and not the company, has the potential to allay some regulatory concerns while creating a more devoted customer base. The company recently said more than 90% of trades processed on the platform are executed in peer-to-peer fashion.

Speaking of regulatory issues, sportsbook operators are treading carefully when it comes to prediction markets because they don’t want to run afoul of state regulations. To little fanfare, Novig recently left New Jersey, and that could be taken into consideration by prospective buyers from the gaming industry because those suitors wouldn’t want to jeopardize sports betting licenses in that state.

No comments yet