Want an Accurate Inflation Forecast? Kalshi Says it Beats Wall Street

Posted on: December 23, 2025, 11:20h.

Last updated on: December 23, 2025, 11:32h.

- Kalshi Research study says prediction markets delivered 40% lower error rate on inflation forecasts over the past 25 months

- Kalshi forecasts also showed reduced error rates during major shocks

- Adds prediction market inflation estimates can be “a valuable complement to traditional forecasts”

In a new study, Kalshi’s newly formed research division said prediction market traders consistently outpace Wall Street experts in forecasting monthly readings of the Consumer Price Index (CPI), the most widely observed gauge of consumer price fluctuations.

Kalshi Research compared the consensus CPI estimates turned out by Wall Street economists with implied pricing on the Kalshi prediction market from February 2023 through mid-2025, discovering that its CPI-linked event contracts sport lower rates of error than the pros’ consensus estimates.

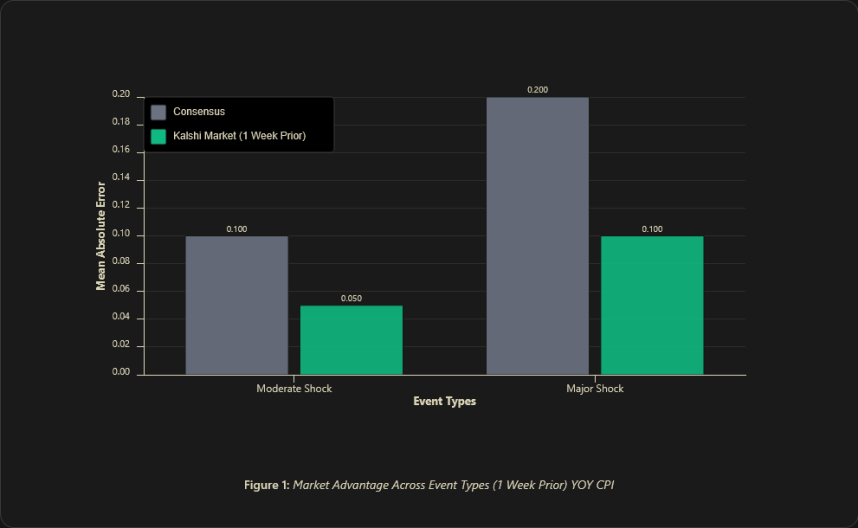

We find that Kalshi forecasts exhibit a 40.1% lower mean absolute error (MAE) than consensus forecasts across all regimes (normal and shock environments), and document significant outperformance during shocks (significant deviations of actual values from consensus that we term “shock alpha”) – recording 50% lower MAE in shocks of > 0.2pp and in shocks of 0.1pp ≤ shock < 0.2pp on a week-ahead timeline,” according to Kalshi Research.

The research firm adds that over the observed period, prediction markets also beat Wall Street CPI estimates when market participants disagree with the consensus forecast. In that case, Kalshi’s win rate is 75%.

Prediction Markets Strong in Predicting CPI Surprises

An area of strength for prediction markets regarding CPI prognostications is beating consensus in projecting CPI surprises – one of which arrived with November’s reading. The official reading came in at 2.7%, well below the 3% consensus estimate.

Kalshi acknowledged the sample size is modest, but adds, the “wisdom of the crowd” can be a powerful tool and additive to the traditional economic forecasts that so many investment professionals have relied on for decades.

“Further, we find preliminary evidence of the ability to predict shocks, with market-consensus deviation showing a positive correlation with forecast surprises and threshold analysis identifying that deviations exceeding 0.1pp predict a ~81.2% shock rate, moving to ~82.4% a day prior to release,” observes Kalshi Research.

Why it Matters

Skeptics may say that Kalshi is tooting its own horn, and the study pertains to just one of several marquee economic data points that are regularly followed by investment professionals. Still, proficiency in event contracts outside the world of sports is critical to prediction markets’ long-term use cases.

By some estimates, prediction market revenue could surge fivefold by 2030, but meeting or beating that projection requires more activity from professional traders focusing on more than just sports contracts. Long-term prediction market success hinges on expanded use cases, including presenting professional investors with viable hedging tools.

“For institutional investors, risk managers, and policymakers, the stakes of forecast accuracy are asymmetric,” concludes Kalshi Research. “A marginally better forecast during uncontroversial periods offers only modest value. But superior accuracy during market dislocations — when volatility spikes, correlations break down, or historical relationships fail — can lead to significant alpha generation and limit drawdowns.”

No comments yet