Robinhood Readying for Prediction Markets ‘Supercycle,’ Says ARK

Posted on: December 22, 2025, 12:10h.

Last updated on: January 6, 2026, 09:06h.

- Robinhood recently announced significant prediction markets expansion

- Cathie Wood’s ARK Investment Management compares prediction markets to traditional financial derivatives

- Wood says Robinhood is on the cusp of a prediction markets “supercycle”

Fresh off a recent announcement regarding a major push into prediction markets, Robinhood Markets (NASDAQ: HOOD) is preparing for an event contracts “supercycle.”

That’s the view of ARK Investment Management analyst Varshika Prasanna, echoing sentiment shared by Robinhood CEO Vlad Tenev at the company’s YES/NO event last week. Prasanna says Robinhood’s prediction markets are live on the Legend platform, which is used by the company’s clients deemed to be active traders. Increased adoption by frequent traders could signal expanded use cases for yes/no derivatives.

Our research suggests that prediction markets are becoming powerful retail investment tools that offer direct exposure to real-world outcomes, much like derivatives and futures in the institutional financial world,” notes Prasanna. “As Robinhood CEO Vlad Tenev suggests, Robinhood is in the early innings of a prediction markets Supercycle. With interfaces more consumer-friendly than those for traditional derivatives and futures data, prediction markets could be on the cusp of mainstream adoption.”

Cathie Wood’s ARK Investment Management is a major Robinhood shareholder and is also an investor in prediction markets giant Kalshi. Two ARK exchange-traded funds (ETFs) are among the top eight in terms of percentage of portfolios allocated to Robinhood shares.

Robinhood Already Flexing Prediction Market Muscle

Prediction markets represent Robinhood’s fastest-growing new business line in the company’s history, with ARK’s Prasanna noting that the segment is on pace to generate $300 million in yearly recurring revenue for the fintech firm by the end of this year.

That’s prompted some analysts to hypothesize that Robinhood’s prediction markets push is a competitive threat to sportsbook operators such as DraftKings and FanDuel — both of which are new on the prediction markets scene. Robinhood is also disrupting some entrenched rivals in the event contracts industry.

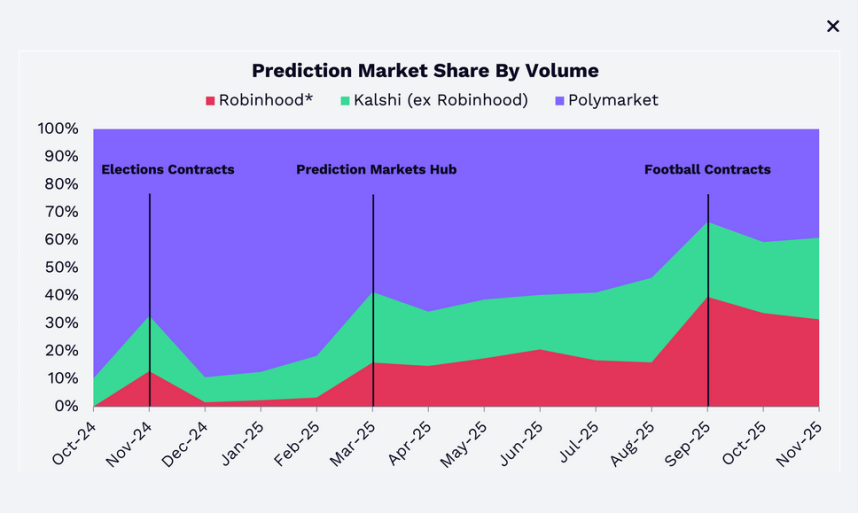

“Moreover, thanks to its partnership with Kalshi, Robinhood has gained meaningful share from its prime competitor, Polymarket,” says Prasanna.

Prediction Markets Could Be Disruptors

Much of this year’s volume surge on exchanges such as Kalshi has been led by sports event contracts, and Robinhood didn’t run away from that at last week’s event, highlighting what it called football “combos,” which is essentially prediction market speak for parlays.

Some experts see other segments, including cryptocurrency prices, culture, economic forecasting, and politics, as pivotal to prediction markets’ growth, and vital regarding reduced dependence on sports event contracts.

“Though they will span many categories, prediction contracts are likely to be most disruptive to financial, economic, and political markets with real-time signals that price the probabilities around consensus assumptions,” concludes ARK’s Prasanna.

No comments yet