IRS (Finally) Confirms Jackpot Reporting Threshold Will Increase to $2,000

The entire casino industry, along with millions of slot machine enthusiasts, has been holding their breath since passage of the so-called “One Big Beautiful Bill Act of 2025.”

Prior to the legislation, casinos were required to issue a form W-2G when a slot jackpot was $1,200 or more. The legislation seemed to increase the threshold to $2,000, but until now, casinos and players have been in limbo because the IRS wouldn’t confirm the change.

Emphasis on “until now.” The IRS has removed its head from its ass and the jackpot reporting threshold will be $2,000 starting Jan. 1, 2026. Otherwise known as the Best New Year’s Eve, ever.

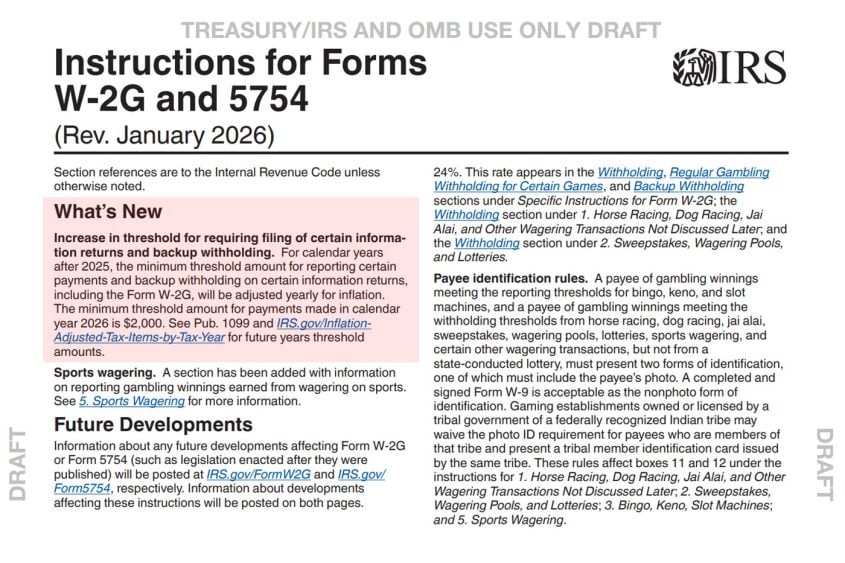

The IRS confirmed the reporting threshold change via a clarification on its Web site in the form of a draft tax form. Here’s the specific draft (.pdf) related to W-2G forms (mostly for the utterly clueless Las Vegas Review-Journal).

So, it’s “official,” but will only be “official-official” when the Office of Management and Budget (OMB) approves it. In this case, expect a rubber stamp.

Interesting side note: “For calendar years after 2025, the minimum threshold amount for reporting certain payments and backup withholding on certain information returns, including the Form W-2G, will be adjusted yearly for inflation.” Our advice: Don’t hold your breath.

But $2,000!

All the casino owners and operators we spoke to are implementing the change, which was not the case even a week ago.

It’s now a race to update their casino operations procedures along with making changes to literally every slot machine in their venues.

It’s expected the changes to the machines won’t happen by Jan. 1, so that will mean machines will still “lock up” at $1,200, but no W-2G will be issued. Attendants will just manually override the system.

The change to the reporting threshold has been a long time coming. The $1,200 threshold was set in 1977, otherwise known as “a metric shit-ton of years ago.”

The IRS reporting threshold should be about $6,600 if indexed for inflation, but we are not going to whine about this very much given a hefty chunk of our personal handpays fall into the sweet spot of between $1,250 and $2,000.

Extrapolating from our personal handpays in 2025, we figure roughly 65% of handpays fall between $1,200 and $1,999. (We have had 168 handpays in 2025, 108 of which were below $2,000. This is not a humble brag. It costs about $4,500 to get a $1,250 handpay.)

So, while we will definitely still pay taxes on all our gambling winnings, as is the law, we love that our gaming will not be interrupted by IRS paperwork.

The increase in reporting threshold is likely to have some fallout for casino staff. Fewer handpays means less need for attendants, which is likely to result in downsizing of that department. We hope they can be trained as techs or whatever, because attendants are some of our favorite people.

Beyond that, slot attendant tips are likely to take a nosedive. Fewer handpays, fewer tips. They’re already taking a hit due to these “fast pay” systems where players provide their tax information to the casino, then bypass handpays by entering a PIN when the machine locks up. They collect all their W-2Gs at the end of the session.

Anyway, let’s stay focused on the positive!

THE IRS THRESHOLD FOR SLOT JACKPOTS IS INCREASING TO $2,000.

Yes, the country is going to lose a lot of revenue, but they’ll make up for it in other ways.

Which leads us to another subject where we want to stay positive, but it involves dumbassery, so gird your loins.

The next challenge for our public officials and the IRS: The One Big Beautiful Bill Act includes a change that, beginning with the 2026 tax year, limits gamblers to deducting only 90% of their gambling losses against their winnings, rather than 100% as allowed under prior law.

This is a major issue for the casino industry. It only affects gamblers who itemize deductions on their tax returns, but those are some of the industry’s best players.

Under the old rules, a gambler who won and lost the same amount over the course of a year could effectively net out to zero taxable gambling income; under the new rule, that same gambler could owe tax on so-called “phantom income,” meaning income that exists on paper but not in reality.

A common example is someone with $100,000 in winnings and $100,000 in losses. If the ill-considered (translation: moronic) new law goes into effect, the player would only be allowed to deduct $90,000, leaving $10,000 subject to tax despite having no actual profit.

Faced with that prospect, gamblers are either going to be forced to fluff up their losses 10%, or they’re going to gamble less. That last part is what’s freaking out the casino industry.

But that is for another time.

Today, we rejoice in the fact the IRS reporting threshold is going up to $2,000.

We are engorged just typing that sentence, especially after all these months of uncertainty.

If you’re thinking, “Why should I care? I’ve never gotten a handpay or W-2G.” Well, here’s our advice distilled down to two words: Uncomfortable denominations. The higher the denom, generally, the lower the hold on the machine. The bulk of our 2025 handpays were due to playing $10/hand ($2 denom) or $25/hand ($5 denom) video poker. If you want to stay off the radar of the IRS, just keep feeding those penny machines, they are the biggest money-makers for casinos.

Highlight: The $25 four-of-a-kind on video poker no longer triggers a W-2G. (If you know, you know. The bulk of our handpays this year were $1,250.)

We are committed to hitting a jackpot under $2,000 on New Year’s Eve just to be able to personally testify to the boundless wisdom of our elected leaders and the Internal Revenue Service.

Actual results may vary, wisdomwise.

Leave your thoughts on “IRS (Finally) Confirms Jackpot Reporting Threshold Will Increase to $2,000”

20 Comments