Atlantic City Casino Tax Revenue for New Jersey Pales Compared to Neighboring States

Posted on: May 8, 2017, 03:00h.

Last updated on: May 8, 2017, 07:13h.

New Jersey’s casino tax revenue take from Atlantic City totaled $237 million in 2015, and some in the Garden State feel that number should be much richer.

Casinos in Atlantic City pay an eight percent tax on their gross gaming revenue to Trenton, plus a 1.25 percent community investment obligation.

That’s quite the bargain for the remaining seven casinos in town compared to effective tax rates on gambling in neighboring states.

According to the American Gaming Association (AGA) and its 2016 State of the States report, New Jersey has the second lowest commercial casino tax rate in the country. Only Nevada taxes its gaming revenue less at 6.75 percent.

But while gaming has rebounded in Nevada following the 2008 and 2009 US recession, that isn’t the case in Atlantic City. Five casinos have shuttered since 2014, the last coming in October of 2016. Still, some believe New Jersey casinos should be anteing up more cash.

“You guys have been ripped off by the casino industry for 30 years,” Meadowlands horse racetrack owner Jeff Gural told the Press of Atlantic City this week. “The tax rate here is a fiasco. Basically what has happened in Atlantic City is that operators have taken profits from here and built competition for Atlantic City.”

AC Starving, Neighbors Feasting

Gural isn’t alone in arguing that Atlantic City casinos should share more of their gaming revenue with New Jersey. Assemblyman Chris Brown (R-Atlantic) also believes the tax code needs amending.

“Casinos should pay their fair share,” Brown opined.

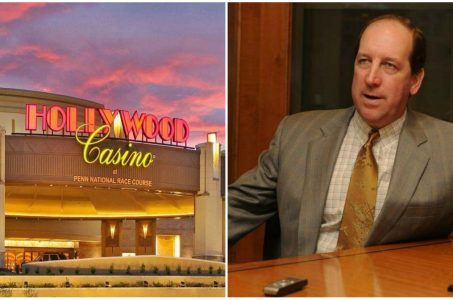

Some might think Las Vegas and Atlantic City are the two biggest casino markets in the country, and individually they are, but when it comes to total statewide gaming, New Jersey isn’t even in the top 10. In neighboring Pennsylvania, the state capital of Harrisburg took in over $1.3 billion in casino taxes by levying a 55 percent slots and 16 percent table games toll.

Opponents to opening up the casino tax revenue discussion say now isn’t the time to place a new financial hardship on the remaining resorts. Atlantic City is trying to find some sort of new norm and economic stability. Keeping a single-digit tax rate is seen by some as an incentive for developers to invest in the beachfront gaming market.

Revel, now named TEN, owner Glenn Straub opined recently that doing business in New Jersey is already tough enough. The outspoken Floridian says the state “rapes” businesses and restricts investment.

States by the Numbers

Casinos paid states over $8.85 billion in tax revenue in 2015, but New Jersey is nowhere near the top of the list.

Top 10 commercial casino tax revenue states

Pennsylvania $1.37 billion

Nevada $881.5 million

New York $864.1 million

Indiana $622.1 million

Louisiana $591.2 million

Illinois $500.6 million

Ohio $484.6 million

Missouri $436.9 million

Maryland $415.9 million

Rhode Island $333.5 million

Pennsylvania’s seemingly exorbitant tax rate hasn’t turned gaming companies away.

The Keystone State is presently home to a dozen casinos, and many of gaming’s most respected companies are invested, including Las Vegas Sands, Harrah’s, Penn National Gaming, and Mohegan Sun.

Related News Articles

Boyd Gaming Completes Cannery Acquisition

Wynn Boston Harbor Paying Top Dollar to Demolish Nearby Homes

Penn National in No Rush to Build Pennsylvania Satellite Casino

Most Popular

Las Vegas Overstated F1 Race’s Vegas Impact — Report

Vegas Strip Clubs Wrestle in Court Over Animal Names

Mega Millions Reportedly Mulling Substantial Ticket Price Increase

Las Vegas Strip Stabbing Near The Strat Leaves One Man Dead

Most Commented

-

End of the Line for Las Vegas Monorail

— April 5, 2024 — 90 Comments -

Mega Millions Reportedly Mulling Substantial Ticket Price Increase

— April 16, 2024 — 6 Comments -

Long Island Casino Opponents Love New York Licensing Delays

— March 27, 2024 — 5 Comments

No comments yet