Top Stories from the Casino.org blog

Insights from the world of online gaming and beyond.

Derby Fever: Ultimate Kentucky Derby States Index

Time to dust off your fascinators as we’re off to the races – it’s Kentucky Derby time! Dubbed “The Greatest Two Minutes in Sports”, fans across America are saddling up to celebrate the embodiment of equestrian excellence, accompanied by a few Mint Juleps of course. In...

April 18, 2024

—

4 min read

What Are The Odds of Winning The Lottery & Why Do People Still Do It?

April 16, 2024

—

9 min read

Learn How To Play Mahjong For Beginners: An Easy-To-Follow Tutorial

April 24, 2024

—

4 min read

Most Popular

Infographics

The Most Superstitious Fan Bases Across Major Professional Sports Leagues

January 17, 2024

—

4 min read

Industry

What is Deck Penetration in Blackjack? (And Why It’s Important)

November 14, 2023

—

5 min read

Latest

America’s Best and Worst Password Security Habits

Cybersecurity is more critical than ever, now that we’re living in a digital world where anyone and everything is up...

April 24, 2024

—

5 min read

From Fairways to Fortune: Who Are The Top 10 Richest Golfers Of All Time?

Today we’re going to run you through the top 10 richest golfers in the world, taking into account tournament prizes...

April 22, 2024

—

6 min read

Everything You Need To Know About Arbitrage Betting To Guarantee A Profit

Arbitrage betting, or ‘arbing’ for short, is where you place bets on all possible outcomes of a sporting event. If...

April 18, 2024

—

6 min read

NFL Betting: What Is An Octopus In Football? And Can You Bet On It?

When a team scores a touchdown, they have the option to score an additional one or two points. An octopus...

April 17, 2024

—

6 min read

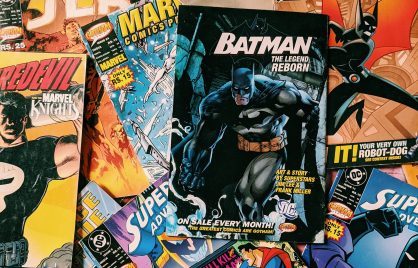

National Comic Book Day: America’s Favorite Comic Book Characters

Wham! Kapow! Boom! There’s nothing quite as iconic as the world of comic books, where vibrant illustrations, onomatopoeic words, and...

April 15, 2024

—

4 min read

The Best Gaming Cities in the US

The skyrocketing growth of the gaming industry in America is no secret, with the video game market projected to soar...

April 15, 2024

—

5 min read

Decoding Casino Lingo: What Exactly Is A Hand Pay In Slots?

A hand pay in slot machine terminology simply means that something has gone very right or wrong and that you...

April 12, 2024

—

4 min read

What Ever Happened To Tommy Hyland?

Card-counting hero and blackjack legend Tommy Hyland earned a place in the Blackjack Hall of Fame back in 2002 –...

April 10, 2024

—

4 min read

Gaming Industry Study: Carbon Emissions of Top Video Games

What do video games and jumbo jets have in common? Carbon emissions, of course! Although we have to consider scale,...

April 10, 2024

—

4 min read

Unmasking The NFL: How Much Do NFL Mascots Make?

Every football fan knows players and coaches make mega money, but how much do NFL mascots get paid? The average...

April 8, 2024

—

5 min read

Basketball 101: How Many Periods Are In A Basketball Game? NBA vs NCAA

NBA and NCAA Men’s games each have a different number of periods that last for varying amounts of time. There...

April 5, 2024

—

4 min read

US Cities with the Most Swifties Per Capita

It’s me, hi, I’m a Swiftie, it’s me! With 53% of Americans identifying as Taylor Swift fans and 4.35 million...

April 5, 2024

—

4 min read

Behind The Neon Lights: How Do Casinos Make Money?

Casinos make money because every game has a house edge created for it. That edge is usually achieved in either...

April 3, 2024

—

4 min read

Blackjack House Edge: How To Beat The Odds

The blackjack house edge is between 0.5% and 2%. While this house edge is quite low compared to many other...

April 2, 2024

—

6 min read

Influencers at Coachella: America’s Take on Influencer Invasion

Coachella is renowned for its top-tier musical lineups and trend-setting fashion statements. From iconic headliners like Lana del Rey or...

April 1, 2024

—

3 min read