R. Paul Wilson On: Credit Card Scams (4/4)

Over the past three articles, I’ve tried to outline the types of credit card scams that anyone might encounter. They all apply to online or live gamblers since by the nature of traveling or playing online, we tend to rely on devices like credit cards or banking apps.

In this final article, I’m going to describe what happened when my own accounts were compromised and the simple steps anyone can do to protect themselves.

No One is Safe

In my last article, I mentioned that I’d had my details stolen twice and had money taken from my accounts on both occasions.

The first time was in the early 2000s after using my card at an internet café in Los Angeles. When I realised the thief had emptied my bank account, I quickly went to the bank, reported the incident and had my funds restored within a few days.

Next, I went to that internet café, booked a terminal and scanned the device for malware.

Sure enough, a key logger was present. So I booked another computer and found the same software. When I informed the manager it became clear he wasn’t going to do anything about it and his attitude suggested he was already aware what was happening.

Within a month the place was closed down and the owners arrested.

It was irritating to be caught out by such a rank scam but satisfying to catch and clean out the guys who ripped me (and countless others) off.

An easy (now obvious lesson) is to not enter sensitive information on a device you do not control.

Equally, be wary of using public wifi, which is a topic I’ll cover another time.

Data Theft – Not if, But When

The second time my card was compromised was not so satisfying.

I awoke one morning to find multiple large payments from one of my account, which were all made within a few hours.

I called my bank, informed them that these payments were not mine and they quickly returned the money, notifying me that I’d been caught in some large-scale data theft where millions of customer accounts had been hacked and sold online.

In this case, I was merely unlucky and there was little I could have done to avoid it. But, worst of all, there was no one to pursue and nothing to prevent it happening again in the future.

This kind of theft is all too common as more companies fall victim to large-scale data theft.

Recently, a friend discovered multiple long-distance Uber fees for trips he never took in a country he wasn’t even in at the time!

A call to the credit card company and another to Uber ultimately resolved the matter but it proves that money can be stolen even within a company’s own system. Dishonest Uber, Lyft and taxi drivers are all too common these days (more on this in another article).

3 Tips For Avoiding Card Scams

When I first met Frank Abagnale (below), who had scammed huge amounts in the 60s and 70s by abusing the cheque system and ultimately became an expert consultant for banks and the FBI; I asked him: “What’s the best way to protect yourself” concerning bank details and credit card theft.

His answer was simple.

First, you need to keep an eye on your accounts.

Look them over every month, even if it might be painful to recount your own spending, it’s important to recognise anything that doesn’t belong, or might be made by an unauthorised user.

This includes companies who might charge an extra fee (or two) without notifying you or sign you up for a subscription when all you wanted was a one-off purchase.

If your bank or credit card offers email or text notifications when you use their card – TAKE IT.

Seriously, you might get a little bored of the constant reminders that you just spent five bucks on a coffee but that one time you learn about the three thousand dollar television being shipped to an address in Alaska will prove that it’s worth the hassle!

With a credit card you need to keep a close eye on monthly payments and pay it off every month if you can, rather than blindly pay a percentage via direct debit.

Put simply: the sooner you identify any kind of fraud on your account, the sooner you can deal with it.

It’s also important to make sure any bank or credit provider offers serious, effective fraud protection and if you can also get insurance or additional cover for your accounts, I’d take that too.

Which brings us to Frank’s second piece of advice: use credit cards instead of debit cards.

His reasoning is that if you realise someone has taken funds directly from your account via a debit card, you have to call your bank and say: “Hey, I’ve been robbed, give me back my money!”

You then depend on the bank’s protection policy to return those funds, which may later be taken back out of your account if the investigation somehow doubts your claim.

If someone uses your credit card, your situation is quite different.

If someone uses your credit card details, you call your bank or credit provider and say: “These transactions are not mine.” You’ll pay them only for the purchases you actually made. This forces the provider to go looking for who stole their money not yours!

Online, my advice is to never click an unsolicited link or even call a number listed in an unexpected email.

If you need to call your bank or log in, go directly to their website for the number or to sign in.

Finally, be cautious when signing up for new accounts on websites that may later prove to be a scam.

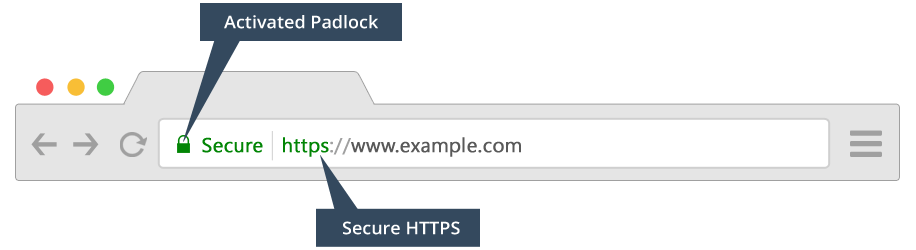

Some con artists create companies and services just to collect credit card and other details via unsecured webpages so always check a page has an SSL padlock beside the URL before entering card details.

Staying Secure On The Road

When traveling, try to use only one or two cards that you can monitor and isolate if they become compromised.

Use cards that provide protection from fraud and travel insurance for cash and belongings since you’ll be able to use that card to buy replacements if your luggage is lost or stolen.

Keep a close eye on how your cards are handled by cashiers, waiters and bartenders and be wary of any situation when your card is taken away to be swiped or processed.

With the advent of wireless Chip and PIN, waiters should bring the machine to your table but there’s still a chance they could swipe your card twice, use a hidden skimmer or simply take a photo of your card (both sides) right under your nose.

If your card is lost, call your provider immediately. Any delay gives a hustler the opportunity to use and abuse that card.

Simple awareness will protect you from 99% of potential scams and quick, effective action will prevent serious losses if your data or property becomes compromised.

Lessons Learned

It’s impossible to be vigilant at all times but if these articles have informed (or reminded) you about how your card details can be stolen or compromised, you have automatically achieved a greater level of protection.

I am generally more paranoid about such things than the average traveler and constantly find myself in scenarios where I recognise the possibility of being scammed.

For example, I recently watched the servers at a Spanish restaurant give every card they processed a wipe to clean the chip because their machine was having trouble reading customers’ chips.

I know this place, I trust the staff, and have no doubt they would never steal a dime from anyone – their machine was simply having problems and cleaning each card quickly was a simple solution.

What amazed me is that no one questioned this cleaning action, which was exactly what a crooked card skimmer would do if he or she had a concealed device. Almost all of these patrons were visitors to Spain and none of them paid any attention to how their cards were being handled.

Consider that all of these customers were magicians – experts in their own form of deception – and you’ll understand my surprise that no one seemed at all concerned.

So, the TL;DR of it all is: monitor your accounts, get notifications whenever you use your cards, lean towards credit cards rather than debit and if anything seems suspicious, act quickly